Gold (XAU/USD) gained traction and climbed to its highest level since October 21, above $4,200, after having spent the previous week in a tight consolidation channel. Nevertheless, heightened doubts about the Federal Reserve’s potential rate cut in December caused XAU/USD to erase a portion of its gains heading into the weekend. With the United States (US) government shutdown coming to an end, investors await clarity on how the economic data backlog will be handled and what they will say about the state of the US economy.

Gold gathers bullish momentum as safe-haven flows dominate

Gold started the week on a bullish note as the improving risk mood made it difficult for the US Dollar (USD) to find demand. Over the weekend, a group of centrist Democrats negotiated a deal, paving the way for the US Senate to approve the temporary funding bill with a 60-40 vote and move one step closer to ending the government shutdown.

On Tuesday, Automatic Data Processing (ADP) reported that private employers shed an average of 11,250 jobs a week in the four weeks ending October 25. This data revived concerns over worsening labor market conditions and caused the USD to continue weakening. In turn, XAU/USD continued to stretch higher.

Late Wednesday, the House of Representatives approved the funding bill as anticipated. Shortly after, US President Donald Trump signed the bill, officially reopening the government. During a briefing with reporters on Wednesday, White House Press Secretary Karoline Leavitt said that the Bureau of Labor Statistics (BLS) might never release the employment and inflation data for October. These remarks caused the USD to come under renewed selling pressure and allowed XAU/USD to extend its rally to a fresh three-week high above $4,200.

On Thursday, the bearish action seen on Wall Street triggered a flight to safety and helped Gold hold its ground. However, hawkish comments from Federal Reserve (Fed) officials caused investors to scale back bets on a December rate cut by the central bank. As a result, Gold lost its bullish momentum and dropped below $4,100 on Friday after closing in negative territory on Thursday.

Fed Bank of St. Louis President Alberto Musalem said that he expects the labor market to stay around full employment and added that they need to proceed with caution now. Meanwhile, Minneapolis Fed President Neel Kashkari reiterated that inflation is still too high. According to the CME Group FedWatch Tool, the probability of a 25 basis points (bps) rate cut in December declined to nearly 50% from about 67% a week earlier.

Gold investors to focus again on US economic data

Market participants are yet to hear an official word about how the backlog of US economic data releases will be handled. There are growing expectations that the BLS could publish the employment data for September as early as next Friday. Even if that’s the case, the September employment figures will be outdated by mid-November, and they are unlikely to trigger a significant market reaction.

The weekly ADP Employment Change data will be closely watched by investors on Tuesday, especially if the BLS confirms that it will not publish the employment report for October. A negative print could feed into fears over worsening labor market conditions and hurt the USD, helping XAU/USD edge higher.

On Friday, S&P Global will publish the preliminary Manufacturing and Services Purchasing Managers’ Index (PMI) reports for November. A reading in the contraction territory, below 50, in either PMI could weigh on the USD and lift XAU/USD. On the other hand, Gold could come under bearish pressure if PMI reports show that the business activity in the private sector continued to expand at a healthy pace.

Comments from Fed officials will continue to grab markets’ attention in the short term. In case policymakers put more emphasis on labor market concerns than on the inflation outlook, markets may view this as a confirmation of further policy easing. Conversely, the USD is likely to preserve its strength and weigh on XAU/USD if central bank officials suggest that they could opt to hold rates steady in December and wait for data to provide a clearer picture of the current state of the economy.

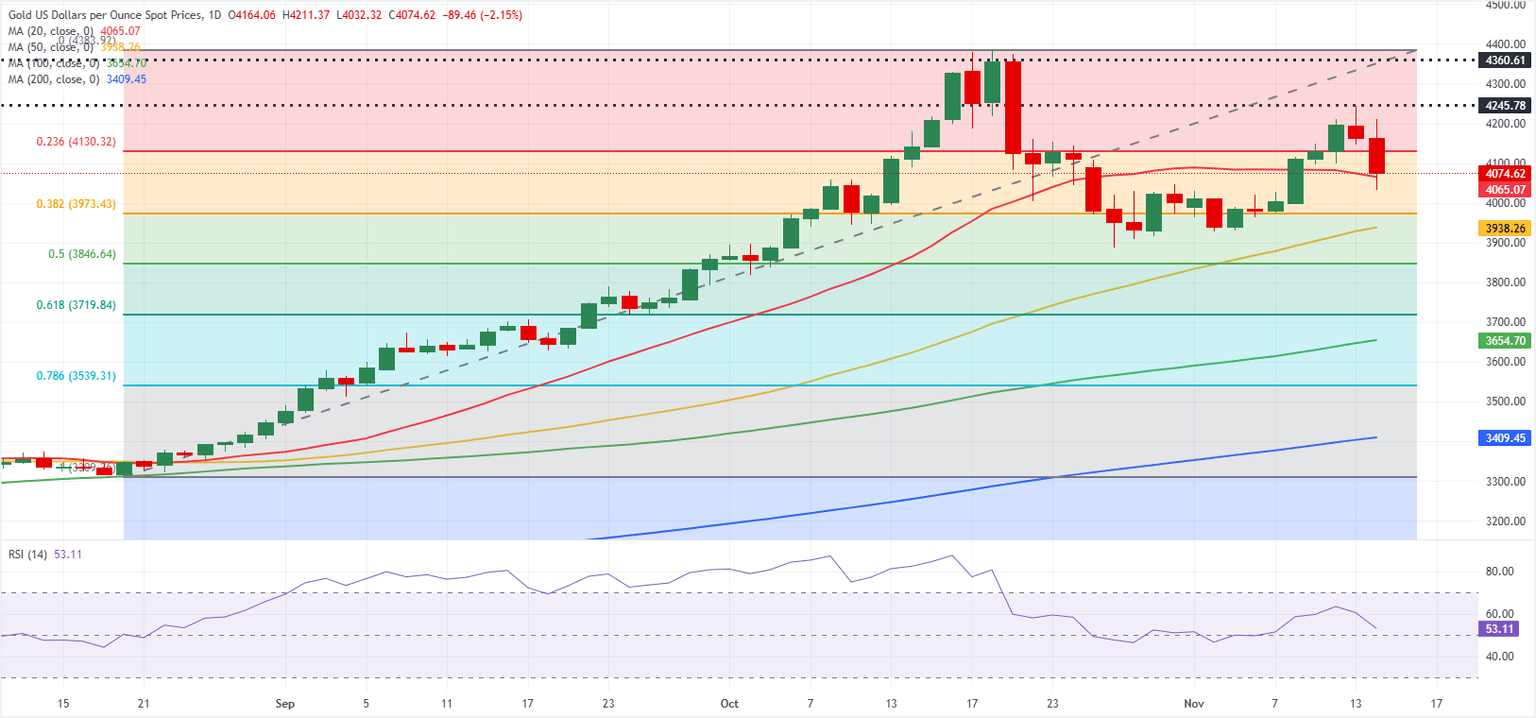

Gold Technical Analysis:

The 20-day Simple Moving Average (SMA) has turned lower, while the 50-, 100-, and 200-day SMAs extend higher, preserving a positive broader tone. Price holds above all these averages, with the 20-day SMA at $4,065.07 offering nearby dynamic support. The Relative Strength Index (RSI) at 53 (neutral) has cooled, reflecting slower upside momentum. Immediate resistance aligns at $4,245, followed by $4,360. A break above the first barrier could extend the advance.

Measured from the $3,310 low to the $4,380 high, the 38.2% retracement at $3,975 offers initial support, with the 50% retracement at $3,845 below. Holding above the former keeps the bullish bias intact, while a close under it could extend the corrective phase toward the latter. Trend support also emerges at the rising 50-day SMA near $3,938.26. A sustained bid above the short-term averages would improve momentum and maintain scope for further gains.

(The technical analysis of this story was written with the help of an AI tool).

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money.

When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions.

The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.