Bitcoin’s (BTC) price has struggled to regain momentum following Wednesday’s drop to $100,700, leaving BTC down roughly 3.5% on the weekly candle. Market data shows long-term holders have sold more than 815,000 BTC over the past 30 days, intensifying the focus on lower liquidity pockets. Analysts now point to the June 2025 lows near $98,000 as the next likely target if volatility accelerates.

Key takeaways:

-

Liquidity clusters show downside pressure building near $98,000 for Bitcoin.

-

A fourth retest of $102,000 to $100,000 support signals a weakening structure.

-

Futures trader positioning remains long-heavy despite rising technical risks.

BTC liquidity compression intensifies downside focus

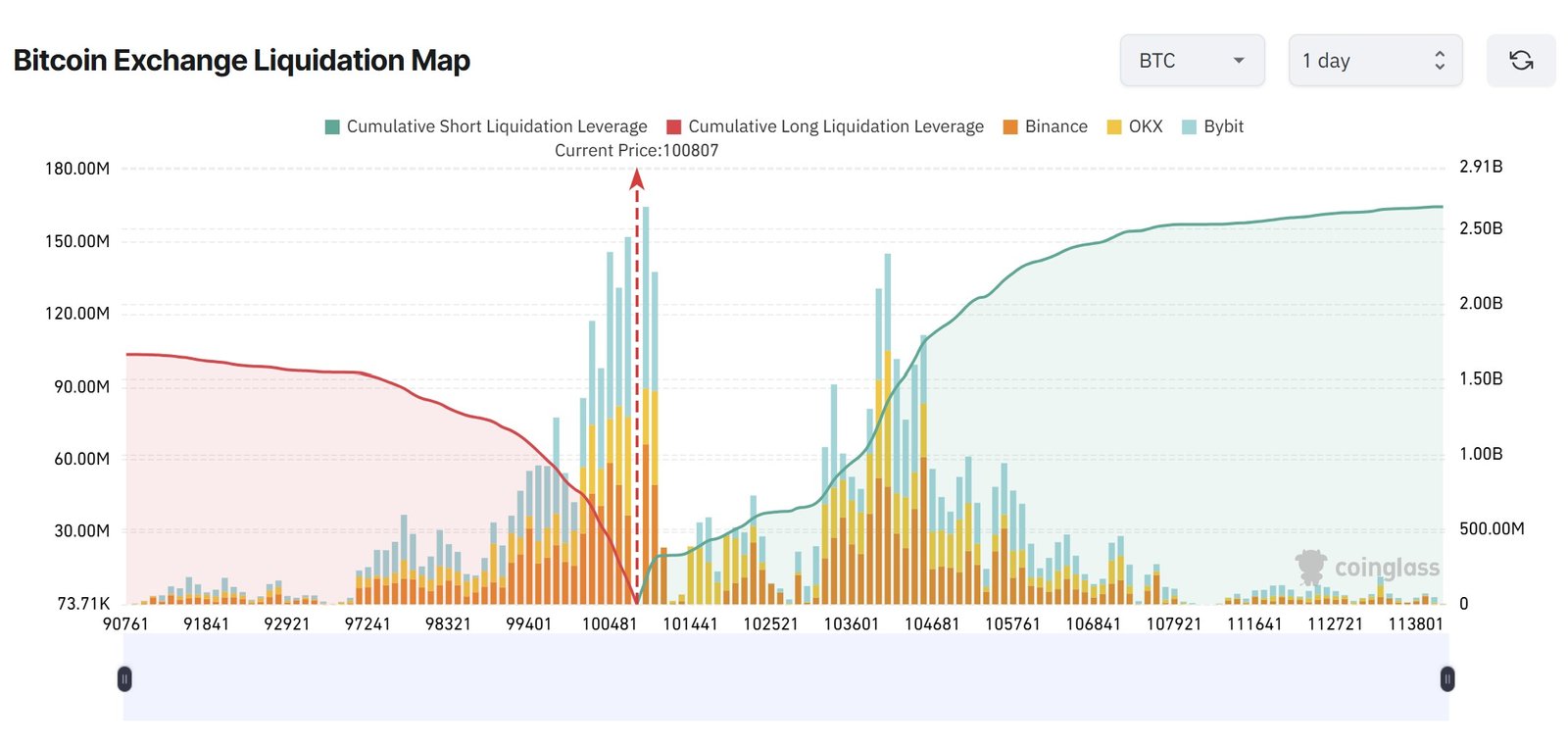

Analysts tracking BTC’s liquidity map highlight a widening imbalance between support and overhead resistance. Crypto trader Daan noted that a “large cluster of liquidity sits below the local lows at $98,000–$100,000,” adding that this aligns with the series of marginally higher lows that have formed above the zone.

The trader also pointed to major upside levels at $108,000 and $112,000 but stressed that only the former is currently actionable given the market structure, with whichever band breaks first likely triggering a sharp squeeze.

Futures trader Byzantine General echoed the sentiment, observing that current price behavior suggests Bitcoin “is likely to sweep the lows around $98,000”.

Supporting this view, CoinGlass data shows nearly $1.3 billion in cumulative long leveraged liquidity concentrated at the $98,000 level, a steep rise from earlier in the week, while futures traders had previously aimed for upside liquidity near $110,000, following the recent flush below $100,000 last Friday.

Related: Crypto most ‘fearful’ since March as Bitcoin eyes one-year lows versus gold

Repeated support retests deepen structural risk

Bitcoin has now tested the $102,000–$100,000 support band for the fourth time since the range was first established in May 2025. Multiple retests of the same support often indicate structural exhaustion: each subsequent visit weakens buyer conviction, reduces resting bid liquidity, and increases the likelihood of a breakdown.

Analyst UBCrypto noted that the latest move resembled a failed breakout, adding that it is “not a level worth buying into” until price confirms strength, even if that means re-entering a few percentage points higher.

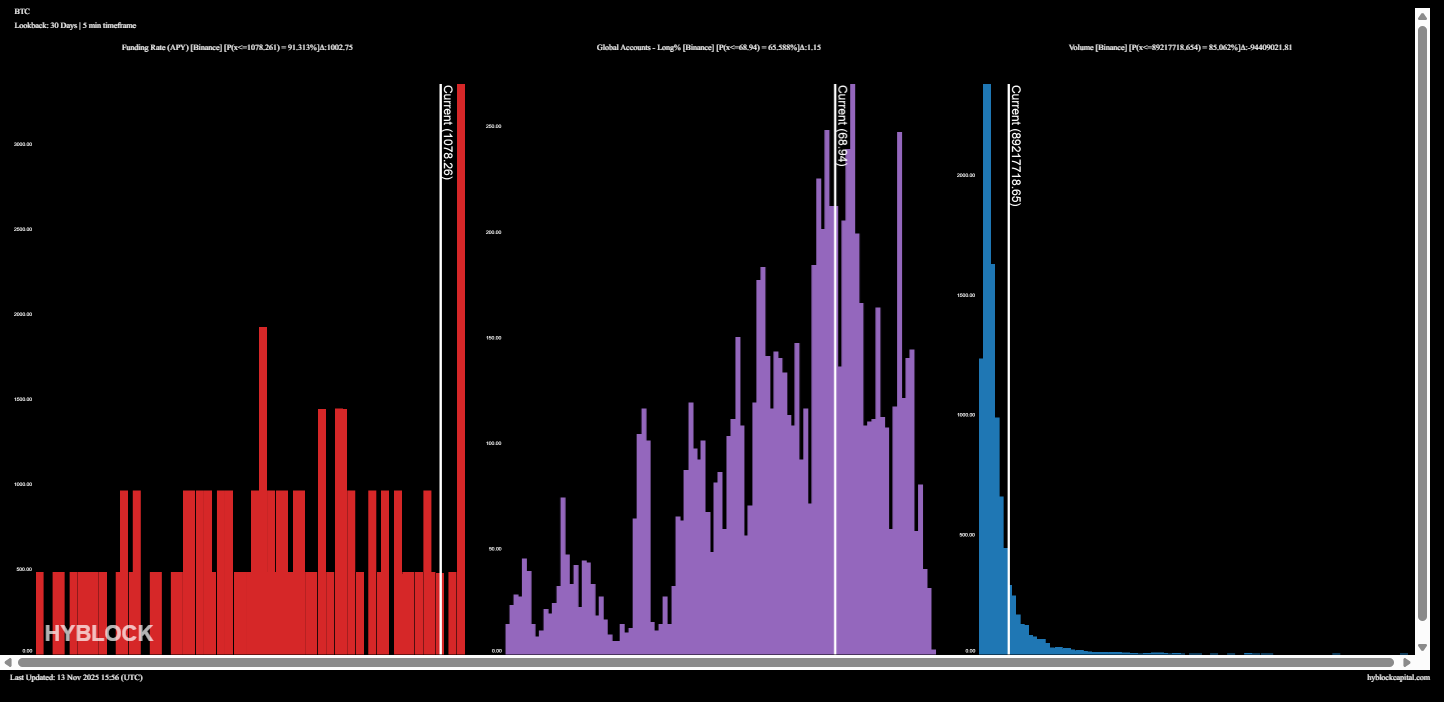

Despite this, data from Hyblock Capital shows that long positioning remains dominant, with 68.9% of global BTC orders leaning long on Binance, indicating that many traders continue to trust the $100,000 floor.

However, both the daily and weekly charts reflect a softness at higher time frames, increasing the likelihood of a liquidity sweep toward $98,000, even as deeper order book support appears to be stacked above the current price.

Related: Bitcoin’s second-largest whale accumulation fails to push BTC past $106K

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.