Key takeaways:

-

Bitcoin lost the $113,000 level as leverage use cooled and speculative bets, creating room for upside volatility.

-

A breakout above would $113,650 confirm an inverse head-and-shoulders pattern, potentially driving BTC toward $120,000.

Bitcoin’s (BTC) recent prolonged consolidation under $113,000 has forced traders to scale back risk, but this cautious stance could be setting the stage for the next breakout. With leverage and speculative positioning cooling, the market currently looks primed for a sharp swing higher, potentially reclaiming $120,000.

Data indicates that Bitcoin price momentum has improved slightly, rising from −8% to −5% over the past week. While sellers still hold a slight advantage, the bearish pressure has eased, signaling the market may be entering the final stages of its “repair zone.”

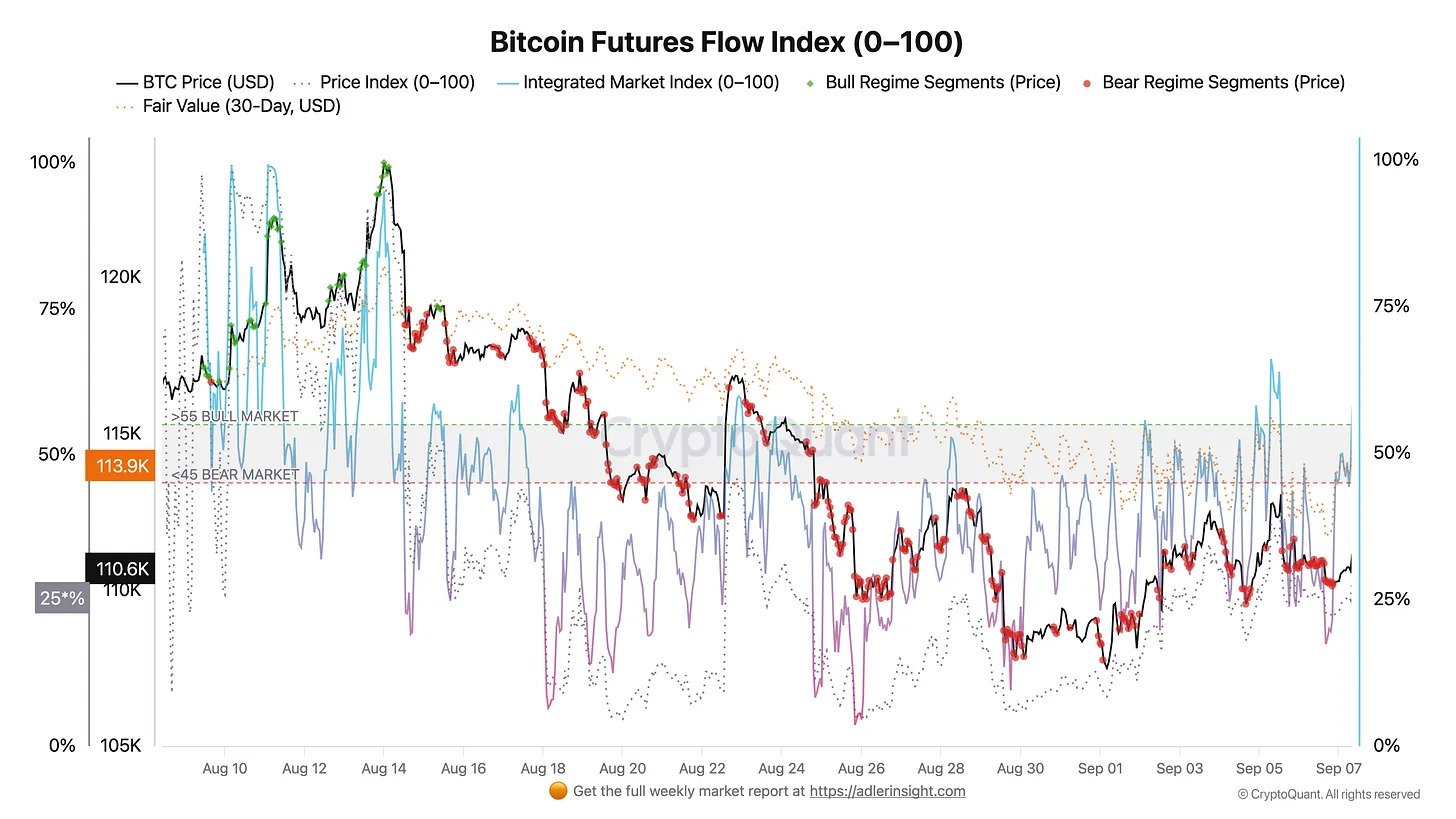

Bitcoin researcher Axel Adler Jr. further noted that futures data suggests traders are taking a step back rather than betting aggressively in either direction. The Integrated Market Index, which had been weighed down by persistent selling, has steadied near neutral levels of 45-50.

Open interest has flattened, pointing to reduced leverage and a shift to defensive positioning. In effect, the market has entered a balance phase where neither buyers nor sellers are in firm control.

Historically, these cooling phases have often set the stage for stronger uptrends. With roughly one-third of the current halving cycle completed, Bitcoin now appears to be forming a base much like it did in Q2, when prices consolidated around $80,000 after bottoming near $74,000 before rallying higher.

The silver lining this time could be that there are fewer overcrowded long positions, reducing the risk of forced liquidations. That creates space for upside volatility to emerge once fresh demand returns, potentially accelerating Bitcoin’s path back toward new highs.

Related: Bitcoin taps $113K as analysis sees ‘return to highs’ on Fed rate cut

Bitcoin eyes $120,000 as key breakout pattern forms

Bitcoin is shaping a bullish inverse head-and-shoulders pattern on the four-hour chart, with its neckline and major resistance set at $113,650. A confirmed breakout above this level could unlock a test of key liquidity pockets, paving the way for a rally of nearly 5.5% toward the $120,000 zone. A daily close above $113,650 will also mark the first bullish break of structure on the daily chart in Q3, indicating a strong trend shift.

Momentum signals are already turning supportive. The relative strength index (RSI) has stabilized above 50, a threshold that often marks the transition from neutral to bullish conditions. Sustaining this level suggests buyers are regaining control, dampening the impact of short-term sell pressure.

Adding to the bullish backdrop, Bitcoin is approaching a crucial technical flip, with the 50-day, 100-day, and 200-day exponential moving averages (EMAs) clustering near current levels. If the price closes above these indicators, the moving averages could shift into strong support, reinforcing the bullish reversal structure.

Related: Bitcoin long-term holders offload 241,000 BTC: Is sub-$100K BTC next?

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.