Bitcoin’s (BTC) recovery from last week’s deep correction is beginning to solidify, with the price pushing back toward the $87,000 to $90,000 zone after sliding from $106,000 to $80,600 in just 10 days.

The rebound has revived discussions about whether BTC has reached a local bottom, even as a key whale cohort continued to offload its supply.

Key takeaways:

-

BTC whale and retail cohorts remained net sellers, but mid-sized holders continued to accumulate.

-

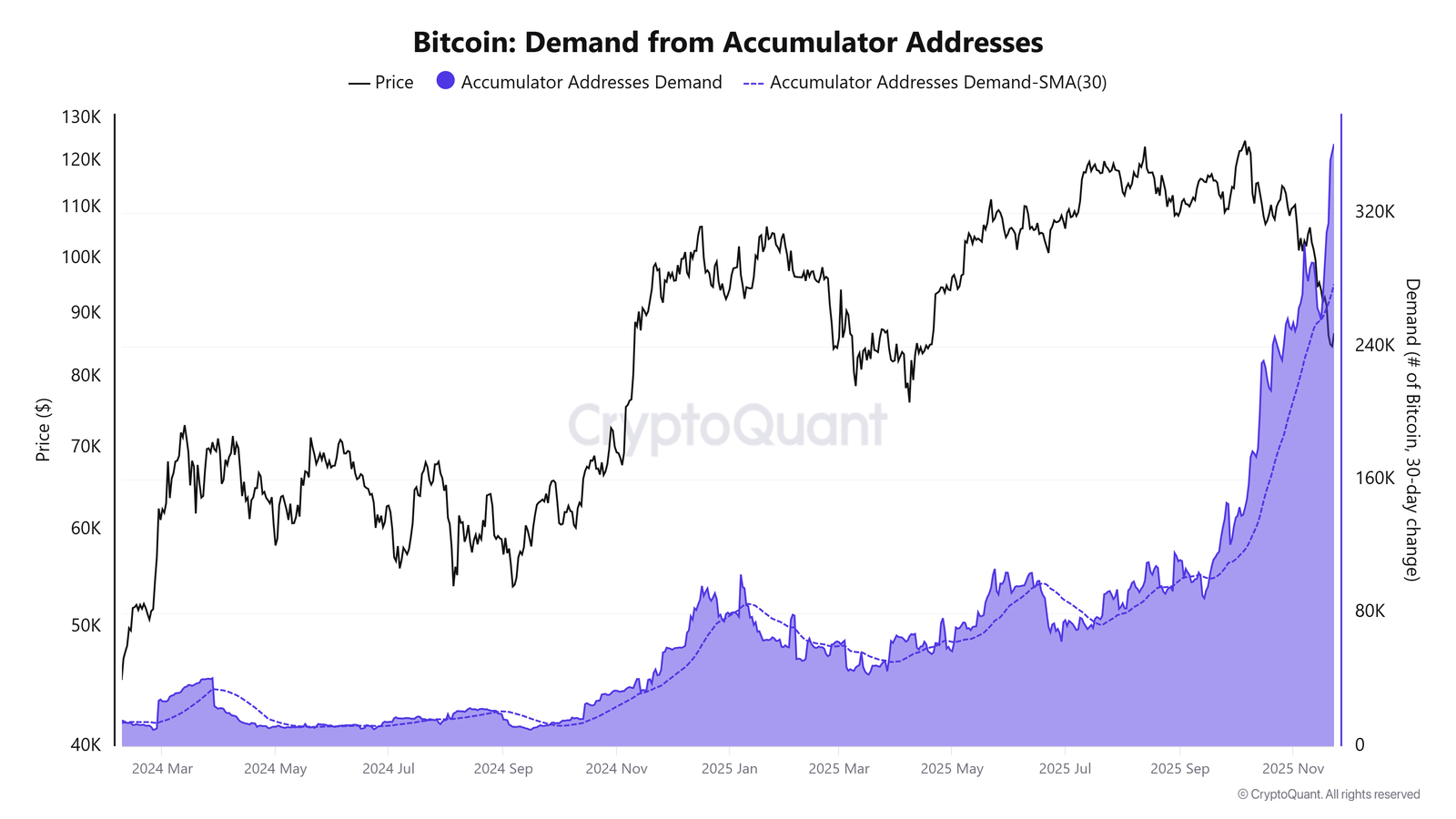

Accumulator-address demand hit a record 365,000 BTC, suggesting a return of long-term confidence.

-

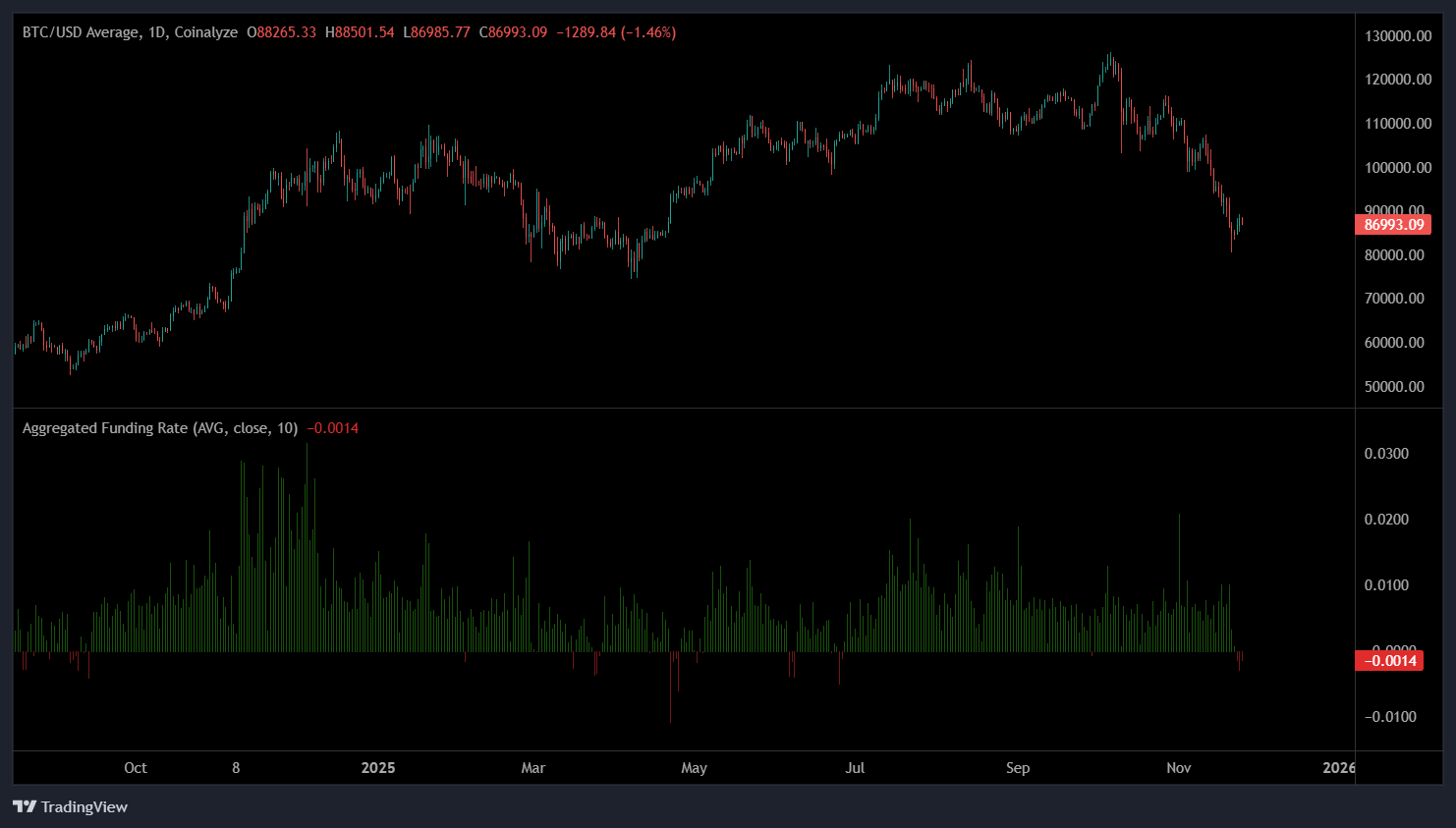

Negative funding rates hinted at trader capitulation and the drive for a short squeeze.

BTC distribution meets a slow-building accumulation trend

Onchain data showed a market defined by uneven cohort behavior. Wallets holding more than 10,000 BTC, along with the 1,000 BTC to 10,000 BTC institutional cohort, have been steady distributors throughout the decline, fueling structural weakness. Retail wallets, those holding under 10 BTC, have also been net sellers over the past 60 days, offering little support during the downturn.

In contrast, mid-sized holders in the 10–100 BTC and 100–1,000 BTC ranges have been accumulating throughout the correction, absorbing part of the sell-side pressure.

These cohorts have grown more visible, as demand from Bitcoin “accumulator addresses” climbed to an all-time high of 365,000 BTC on Nov. 23, up from 254,000 BTC on Nov. 1, marking a substantial increase in conviction-driven demand.

The interplay between these groups could help stabilize BTC after the initial drop, laying the groundwork for the rebound toward $90,000.

Related: Over 8% of Bitcoin changed hands in week, markets on ‘knife’s edge,’ Analysts say

Negative funding rates hint at a short squeeze

The futures market played a decisive role in the recent crash, as cascading long liquidations, forced selling, and margin calls drove BTC sharply into $80,000 range. Now, futures data indicated signs of exhaustion among leveraged longs.

Data from CryptoQuant reported that traders who attempted to long the correction “have finally been squeezed out,” with daily funding rates cooling dramatically and briefly turning negative. With Binance’s neutral funding level near 0.01%, any dip below it signaled short dominance, often seen when traders capitulate late into a correction.

Crypto analyst Darkfost warned that if shorts continue piling in while BTC grinds higher, the market could enter a classic “disbelief phase,” potentially setting up a powerful short squeeze.

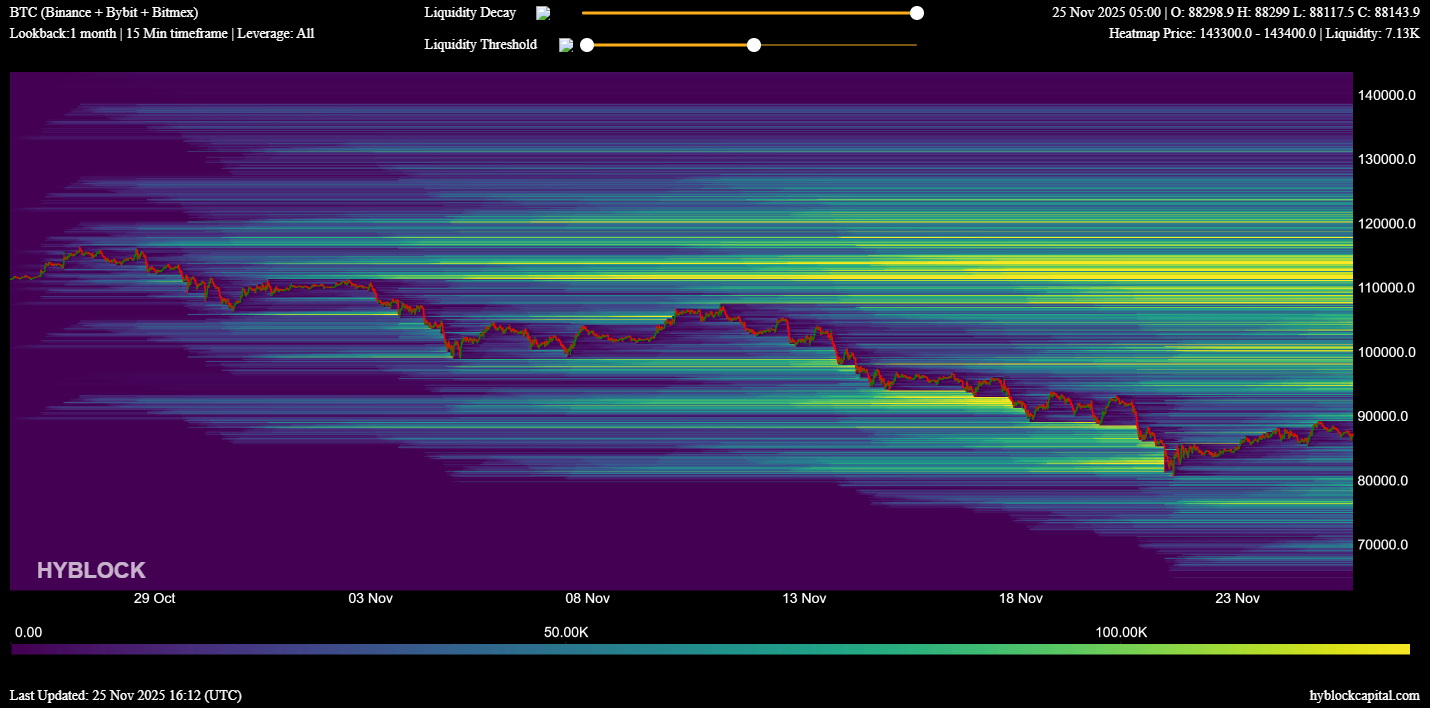

Liquidation heatmaps from Hyblock Capital supported this scenario, with long liquidations totaling $2.6 billion at $80,000, while short liquidations surged over $8.4 billion near $98,000. As illustrated below, dense liquidity bands at $94,000, $98,000, and $110,000 could act as magnets for Bitcoin’s price action.

Related: High percentage of Bitcoin, ETH, SOL held at a loss: Is it a bear market sign?

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.