Bitcoiners were noticeably more upbeat on social media today as the odds of a US Federal Reserve rate cut in December nearly doubled compared to just a day earlier.

Some crypto market participants are speculating that this could be the catalyst Bitcoin (BTC) needs to halt the asset’s downward trend.

“Let’s see if that’s enough to find a bottom here for now,” crypto analyst Moritz said in an X post on Friday, as Bitcoin’s price trades at $85,071, down 10.11% over the past seven days, according to CoinMarketCap.

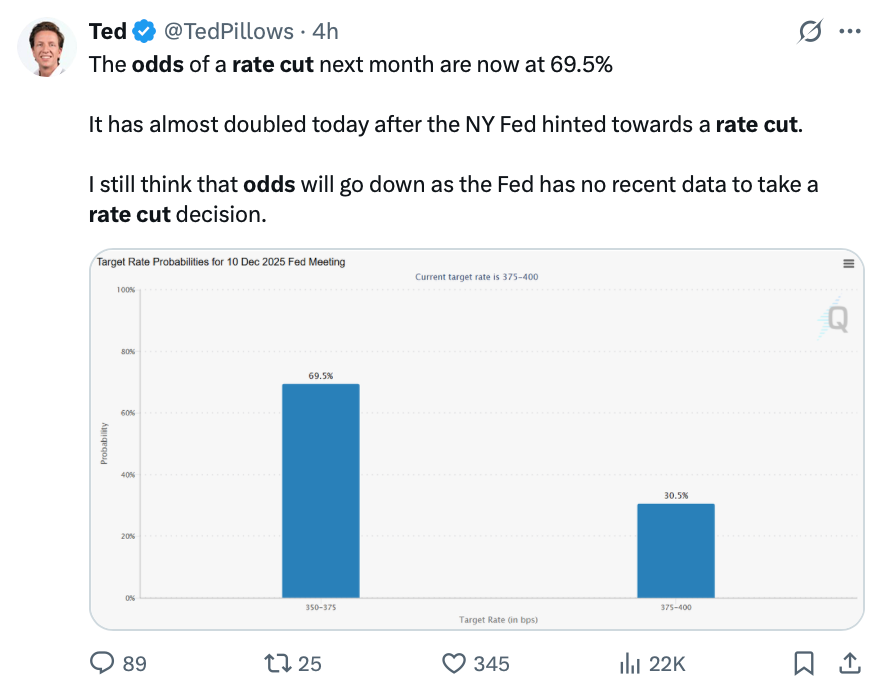

On Friday, the odds of an interest rate cut at the December Federal Open Market Committee (FOMC) meeting almost doubled to 69.40%, according to the CME FedWatch Tool. Just the day before, on Thursday, it was nearly 30.30% lower, at 39.10%.

Many in the wider market attributed the spike at least partly to dovish remarks from New York Fed president John Williams, who said the Fed can cut rates “in the near term” without endangering its inflation goal. Bloomberg analyst Joe Weisenthal said it was the reason the odds have “massively increased.”

The setup is looking “unfathomably bullish,” says analyst

However, economist Mohamed El-Erian warned market participants not to get “carried away” by the comments. Meanwhile, the broader crypto community has reacted even more bullishly. “Usually this would be bullish,” Mister Crypto said in an X post on Friday.

The Fed cutting rates is typically bullish for riskier assets such as Bitcoin and the broader crypto market, as traditional assets such as bonds and term deposits become less lucrative to investors.

Crypto analyst Jesse Eckel pointed to the surging rate cut odds and said, “If you zoom out, the setup is unfathomably bullish.”

“I don’t know why we keep going lower,” Eckel said. “We are going from a tightening cycle into an easing cycle,” he added.

Crypto analyst Curb said, “Crypto will explode in a massive rally.”

The odds of a rate cut were previously “mispriced”

Coinbase Institutional said in a X post on Friday, “While markets are leaning toward ‘no cut’ this time, we believe the odds for a rate cut are actually mispriced. Recent tariff research, private market data, and real-time inflation indicators suggest otherwise.”

Related: BTC ETF outflows are ‘tactical rebalancing,’ not institutional flight: Analysts

“Since the October FOMC meeting, futures have shifted from expecting a 25bps cut to favoring a hold, mainly due to rising inflation concerns,” Coinbase Institutional said.

“However, studies show that tariff hikes can lower inflation and increase unemployment in the short term, acting like negative demand shocks,” it added.

It comes as sentiment across the entire crypto market has remained weak over the past seven days. The Crypto Fear & Greed Index, which measures overall crypto market sentiment, posted an “Extreme Fear” score of 14 in its Friday update.

Magazine: Bitcoin whale Metaplanet ‘underwater’ but eyeing more BTC: Asia Express