The transfer of Bitcoin (BTC) from long-term holders, also known as “OGs,” to “weak” hands will cause future drawdowns to be more severe, according to gold investor and economist Peter Schiff.

Bitcoin is “finally having its IPO moment,” Schiff said on Saturday, adding that there is now enough liquidity in the Bitcoin market for long-term holders to cash out.

“This much Bitcoin moving from strong to weak hands not only increases the float, but also means future selloffs will be bigger,” Schiff added.

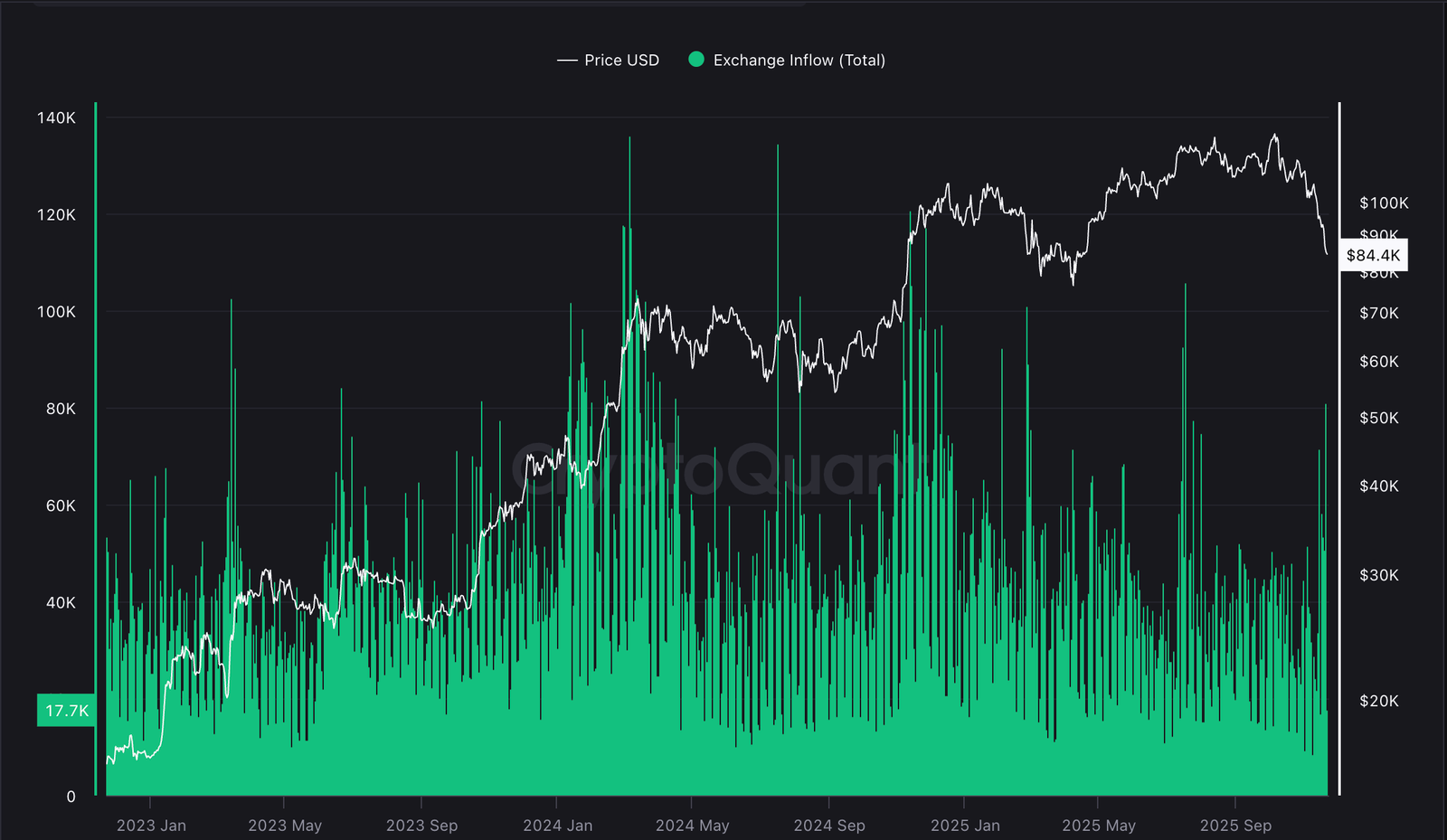

Whales and other long-term Bitcoin holders dumped over 400,000 BTC in October, contributing significant selling pressure, which caused the price of BTC to crash below $85,000.

The ongoing crypto downturn has left analysts and investors divided about the direction of the market and whether the bull trend will resume once liquidity conditions improve or if we are facing the next crypto bear market.

Related: Peter Schiff calls Strategy’s model ‘fraud,’ challenges Saylor to debate

High-profile, long-term holders cash out, but can retail and institutions absorb the selling pressure?

Owen Gunden, one of the earliest long-term Bitcoin holders, cashed out, selling his entire stash of 11,000 BTC, valued at about $1.3 billion, in October and November.

Robert Kiyosaki, the author of “Rich Dad, Poor Dad” and an investor, announced on Friday that he sold all of his BTC, valued at about $2.25 million.

Kiyosaki said that he purchased BTC when it was about $6,000 per coin and sold it at the $90,000 level. He added that he will funnel the profits into income-producing businesses.

“I am still very bullish and optimistic on Bitcoin and will begin acquiring more with my positive cash flow,” Kiyosaki said.

The strong selling pressure from long-term holders cashing out and leveraged liquidations in crypto derivatives markets are the main factors driving the short-term drawdown, analysts at crypto exchange Bitfinex said.

Bitcoin’s fundamentals remain strong and attractive to institutional investors, who will continue to adopt BTC and drive demand, according to the Bitfinex analysts.

However, retail investors will likely sell their BTC at the first sign of trouble, Vineet Budki, CEO of venture firm Sigma Capital, told Cointelegraph, adding that this lack of conviction among retail investors will drive a 70% price drawdown in the next bear market.

Magazine: Danger signs for Bitcoin as retail abandons it to institutions: Sky Wee