Corporate Bitcoin holdings continue to climb, but treasury executives argue the trend is strengthening, not weakening, decentralization across the network.

Despite increasing concerns about concentrated Bitcoin (BTC) ownership, emerging corporate treasury firms and new institutional players are contributing to broader distribution across the ecosystem, according to several executives speaking at Bitcoin Amsterdam 2025.

“At the end of the day, what we are doing is really decentralizing Bitcoin. It doesn’t seem like that, but it is the case through the demand that we provide in the market,” said Alexander Laizet, board director of Bitcoin strategy at Capital B.

Laizet said more banks offering Bitcoin custody options are giving individuals and corporations new avenues for storage and reducing single-point dependence on a small set of custodians.

Related: Bitcoin ETFs bleed $1.1B as analysts warn of ‘mini’ bear market at pivotal moment

Corporations amass nearly 7% of the total Bitcoin supply

Corporations and Bitcoin exchange-traded funds (ETFs) are quietly amassing the Bitcoin supply, increasingly centralizing the distribution of the world’s first cryptocurrency.

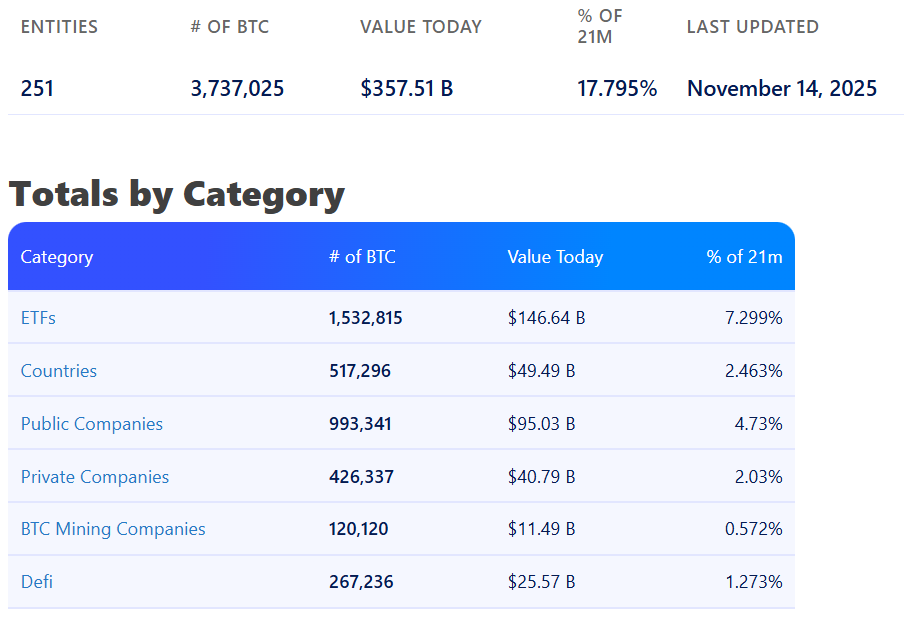

Corporate participants have already amassed 6.7% of the total Bitcoin supply, including 4.73% through public companies and 2.03% through private companies, according to treasury data provider bitbo.io

Spot Bitcoin ETFs have also accumulated nearly 7.3% of the Bitcoin supply, becoming the largest segment of holders in less than two years since their debut in January 2024.

The growing centralized holdings are not an “immediate threat” for Bitcoin, as its “economic ownership is still spread across many underlying investors — not a single actor,” Nicolai Sondergaard, research analyst at crypto intelligence platform Nansen, told Cointelegraph.

“It doesn’t change Bitcoin’s fundamental properties. The network remains decentralized even if custody becomes more centralized.”

While this doesn’t present an “Achilles heel” for Bitcoin, it highlights that large custodial players may have “more influence over liquidity and market behaviour” as their BTC holdings continue to grow, he added.

Related: Metaplanet’s Bitcoin gains fall 39% as October crash pressures corporate treasuries

Still, some industry watchers are growing concerned about Bitcoin’s increasing institutional adoption as corporate crypto treasuries surpassed $100 billion in digital asset holdings in August.

Bitcoin’s growing corporate concentration may present a new centralized point of vulnerability, setting BTC on the same “nationalization path” as gold in 1971, according to crypto analyst Willy Woo.

“If the US dollar is structurally getting weak and China is coming in, it’s a fair point that the US might do an offer to all the treasury companies and centralize where it could be then put into a digital form, not create a new gold standard,” Woo said during a panel discussion at Baltic Honeybadger 2025, adding:

“You could then rug it like happened in 1971. And it’s all centralized around the digital Bitcoin. The whole history repeats again back to the beginning.”

In 1971, US President Richard Nixon ended the Bretton Woods system, suspending the dollar’s convertibility into gold and abandoning the fixed $35-per-ounce rate, effectively ending the gold standard.

Magazine: Mysterious Mr Nakamoto author — Finding Satoshi would hurt Bitcoin