Key takeaways:

-

A US government shutdown resolution might spark a short squeeze, yet traders remain skeptical that it alone can sustain Bitcoin’s move beyond $112,000.

-

Investor caution grows as AI valuations and weak consumer earnings weigh on risk appetite, limiting conviction in Bitcoin’s rally potential.

Bitcoin (BTC) reclaimed the $106,000 level on Monday as the US government shutdown appeared to be nearing an end. Analysts had warned that an extended funding halt could further dampen consumption, especially after thousands of flights were canceled. As the tech-heavy Nasdaq Index rose 1.5%, the cryptocurrency market followed suit.

Traders are now assessing whether Bitcoin’s latest gains can hold amid weak demand for bullish positions in BTC derivatives.

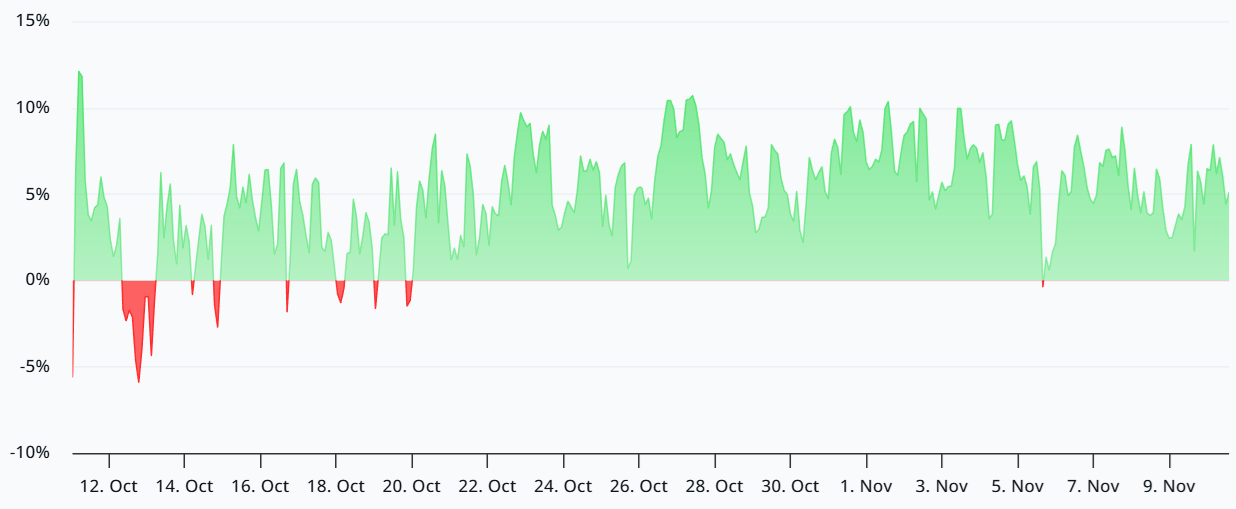

Two-month BTC futures currently trade at a 4% premium over spot markets, which is below the 5% threshold considered neutral. The lack of appetite for leveraged long positions likely reflects the $270 million in forced liquidations that occurred between Tuesday and Wednesday, after Bitcoin lost support at $107,000. Buyers may need additional confirmation that the economy is indeed entering a recession before reentering the market.

The US Federal Aviation Administration has been forced to scale back domestic operations, leading airlines to cancel more than 5,000 flights, according to Yahoo Finance. Some air traffic controllers, who have gone unpaid for nearly a month, have stopped reporting for duty. Despite the unusual Sunday session in the US Senate, there was still no assurance that the standoff would be resolved. A breakthrough in the government shutdown could strengthen optimism among Bitcoin traders.

The US Supreme Court has questioned President Donald Trump’s authority to set certain import duties. The uncertainty surrounding both the duration of the ongoing government shutdown and the sustainability of additional import tariffs adds another layer of risk.

Bitcoin mirrors broader market anxiety over US economic weakness

While the short-term economic consequences remain unclear, the overall effect has so far supported the fiscal budget by delaying expenditures and generating extra revenue. Still, Bitcoin is not immune to broader market concerns about weakness in the US economy.

The BTC options skew (put-call) declined to 6% on Monday, marking the edge of a neutral-to-bearish market for the first time in November. When traders anticipate a sharp correction, the metric typically jumps to 10% or more, as put (sell) options trade at a premium. What might restore traders’ confidence in a potential $120,000 rally remains uncertain, but the current setup clearly signals skepticism.

Unlike monthly BTC futures, perpetual contracts typically remain closer to spot Bitcoin prices due to their adjustable funding rate. These contracts are the preferred tool for retail traders, making it relevant to assess whether sentiment has improved following Bitcoin’s recent retest of the $106,000 level.

Under balanced conditions, the funding rate should range between 6% and 12% to reflect both risk and opportunity costs. The current 5% rate is somewhat troubling, showing a clear lack of interest from retail traders even after Bitcoin tested the $100,000 support on Friday. However, this absence of demand for leveraged bullish positions should not be mistaken for outright bearish sentiment.

Related: End to US gov’t shutdown sparks institutional buying, ETF ‘floodgate’ hopes

Fears of excessive valuations in the artificial intelligence sector and weakness in consumer-focused corporate earnings have led investors to become more risk-averse. The eventual end of the government shutdown could ease tensions and push Bitcoin above $112,000, potentially triggering a short squeeze. For now, however, betting on a bullish breakout solely on the shutdown’s resolution appears overly optimistic.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.