Key points:

-

Bitcoin sees a repeat bull signal from its MACD indicator, which last came in early April.

-

Price then climbed 40% in a month, which this time would give BTC a $160,000 target.

-

US macro data is quickly making traders short-term bullish on Bitcoin.

Bitcoin (BTC) could reach $160,000 in September as a classic onchain indicator flips bullish.

New findings from popular trader BitBull reveal a key “golden cross” on Bitcoin’s moving average convergence/divergence (MACD) chart.

Bitcoin MACD repeats April golden cross

Bitcoin may perform worse in September than any other month on average, but this year could form a major exception.

MACD, which compares price action across shorter and longer timeframes using two simple moving averages (SMAs), has offered bulls a reason to celebrate.

On Friday, the MACD line, a derivative of the SMAs, crossed above the signal line, which is a nine-period exponential moving average (EMA) of the MACD line used for buy and sell signals.

This has positive implications for short-term price strength, but this latest cross is even more interesting.

“Bitcoin just had a MACD golden cross on the daily timeframe. But this one is a bit different,” BitBull explained this week.

“For the first time since April bottom, BTC had a MACD bullish cross below 0 line.”

Negative MACD values reflect local downtrends, and the cross provides fresh fuel for a market rebound.

“Last time it happened, BTC rallied 40% in a month and hit a new ATH,” BitBull notes.

If history repeats, BTC/USD would reach $160,000, already a popular price target for a 2025 high.

Inflation data boosts BTC price sentiment

Bullish sentiment continues to flow back into crypto thanks to macroeconomic shifts.

Related: Bitcoin price cycles ’getting longer’ as new forecast says $124K not the top

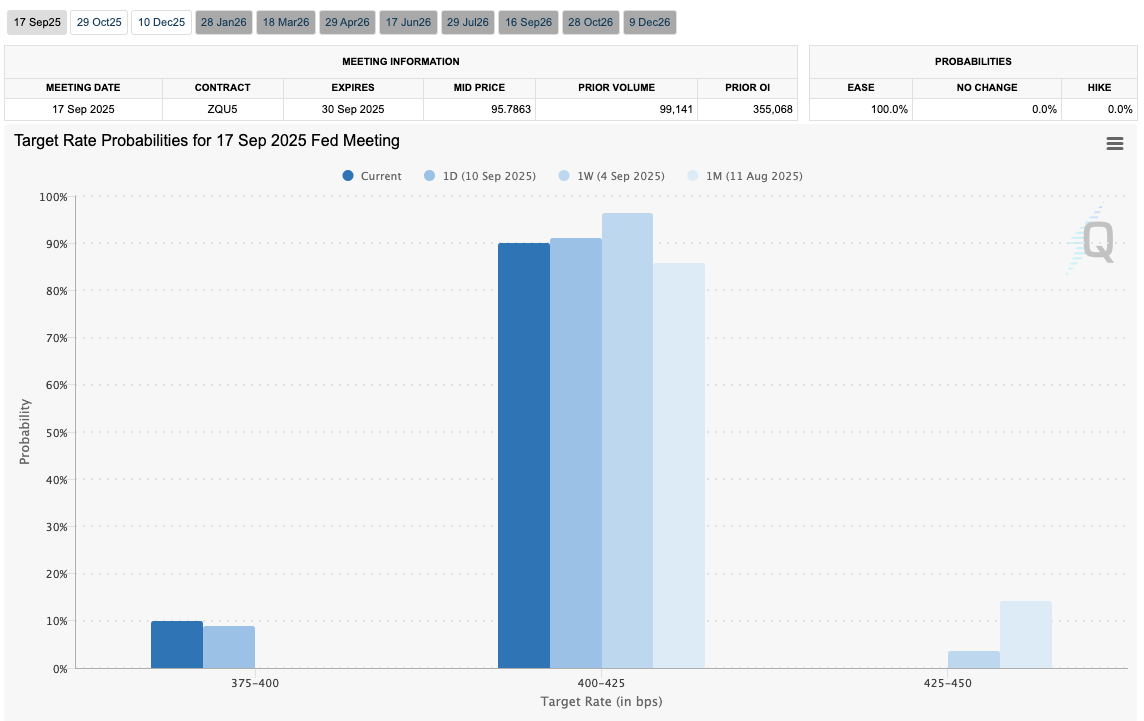

US inflation data has buoyed risk assets and gold, with expectations favoring interest-rate cuts by the Federal Reserve to restart from next week.

The August print of the Consumer Price Index (CPI) is due on Thursday, with traders keen to see a positive result build on BTC price upside.

“If we get a similar print, that’ll confirm the rate cut later this month, and markets will react positively,” popular trader Jelle summarized in part of pre-CPI market coverage on X.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.