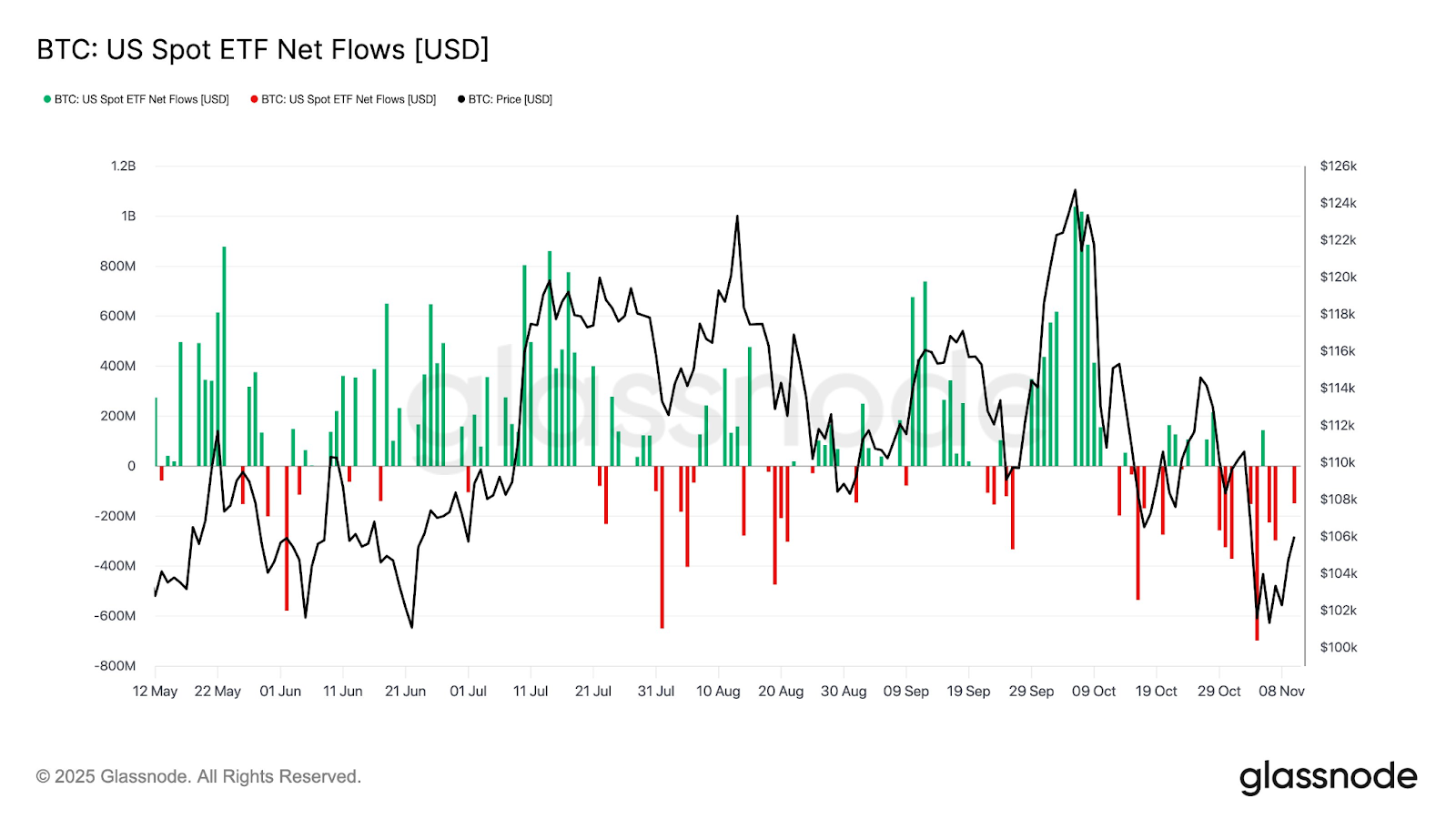

Bitcoin exchange-traded fund (ETF) investments are showing signs of recovery, signaling a return of risk appetite following a record crypto market crash in early October.

US spot Bitcoin ETFs saw $524 million worth of cumulative net inflows on Tuesday, marking the highest daily amount since Oct. 7, according to data from Farside Investors.

The $524 million inflows mark the highest cumulative inflows since the crypto market crash on Oct. 10, which delivered a significant blow to crypto investor appetite.

The positive daily inflows are a welcome signal for Bitcoin (BTC) holders, as investments from ETFs and Michael Saylor’s Strategy were the two main vehicles driving demand for Bitcoin’s price this year, according to Ki Young Ju, founder and CEO of crypto analytics platform CryptoQuant.

The growing demand from ETF buyers came a day after the US Senate approved a funding package that brought Congress one step closer to ending the government shutdown. The legislation is now headed for a full vote in the House of Representatives, which may occur later today, according to a Tuesday report by CBS News.

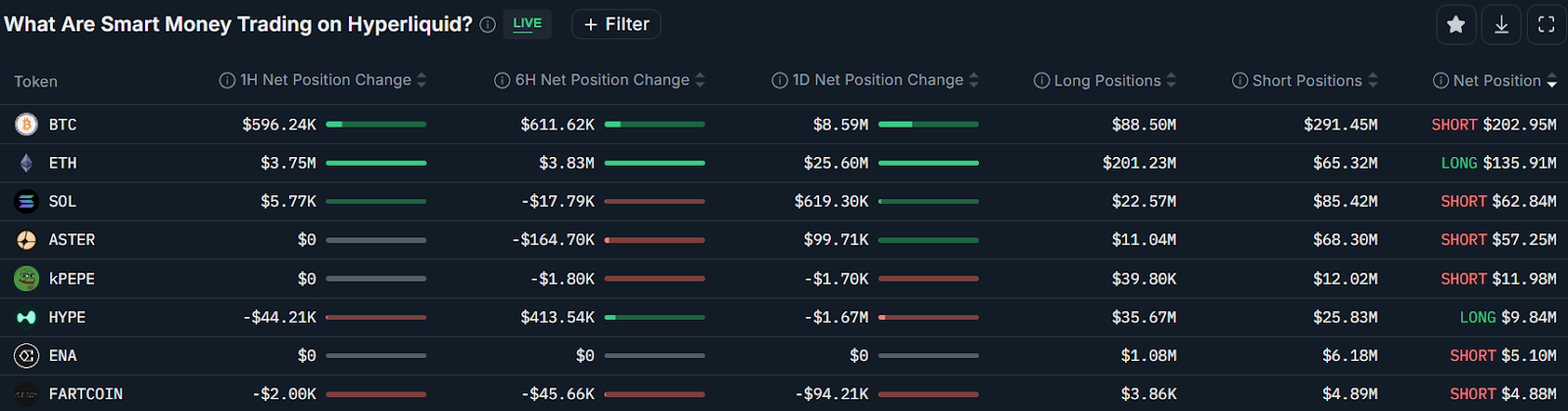

The development inspired a repositioning for more upside among the industry’s most successful traders, tracked as “smart money” traders on Nansen’s blockchain intelligence platform.

Smart money traders have added over $8.5 million worth of net long Bitcoin positions over the past 24 hours, signaling a growing optimism. However, smart traders were still net short by $202 million on decentralized exchange Hyperliquid, according to Nansen.

Related: CleanSpark plans $1.15B raise to expand Bitcoin mining, AI infrastructure

Analysts call correction healthy despite retail worries

Despite retail concerns over the end of the bull cycle, Bitcoin’s current correction remains in a “healthy” range, helping reset leverage and “paving the way for renewed institutional entry,” Lacie Zhang, research analyst at Bitget Wallet, told Cointelegraph.

“Looking ahead, all eyes turn to the Nov. 13 CPI print, though a continued data delay from the government shutdown adds uncertainty.”

Cooling inflation data may ease geopolitical concerns and lead to a “liquidity-driven rebound” for the world’s largest cryptocurrency, the analyst added.

Related: 61% of institutions plan to boost crypto exposure despite October crash: Sygnum

Meanwhile, sustained inflows from Bitcoin ETFs may signal that the “de-risking phase” of ETF holders is coming to an end, as investor demand for digital assets is returning after the crash.

Bitcoin ETFs have been mostly in the red since the October crash, with daily outflows reaching up to $700 million, which pointed to a “broader de-risking phase among ETF investors,” wrote crypto data platform Glassnode, in a Tuesday X post.

As for the other crypto ETFs, Ether (ETH) ETFs saw $107 million worth of outflows on Tuesday, while the Solana (SOL) ETFs extended their 11-day winning streak with $8 million worth of net positive inflows, according to Farside Investors.

Magazine: Bitcoin to see ‘one more big thrust’ to $150K, ETH pressure builds