Key takeaways:

-

Bitcoin’s drop below $100,000 comes as a Wyckoff Distribution pattern points to a potential decline toward $86,000.

-

Some analysts remain optimistic, arguing that the bull market will hold as long as the $94,000 support level remains intact.

Bitcoin (BTC) has just slipped under the key $100,000 support level, driven by hawkish Federal Reserve prospects and persistent whale selling.

Now, a classic technical breakdown setup is strengthening the case for prolonged selling in the Bitcoin market.

Wyckoff distribution model warns of BTC price drop to $86,000

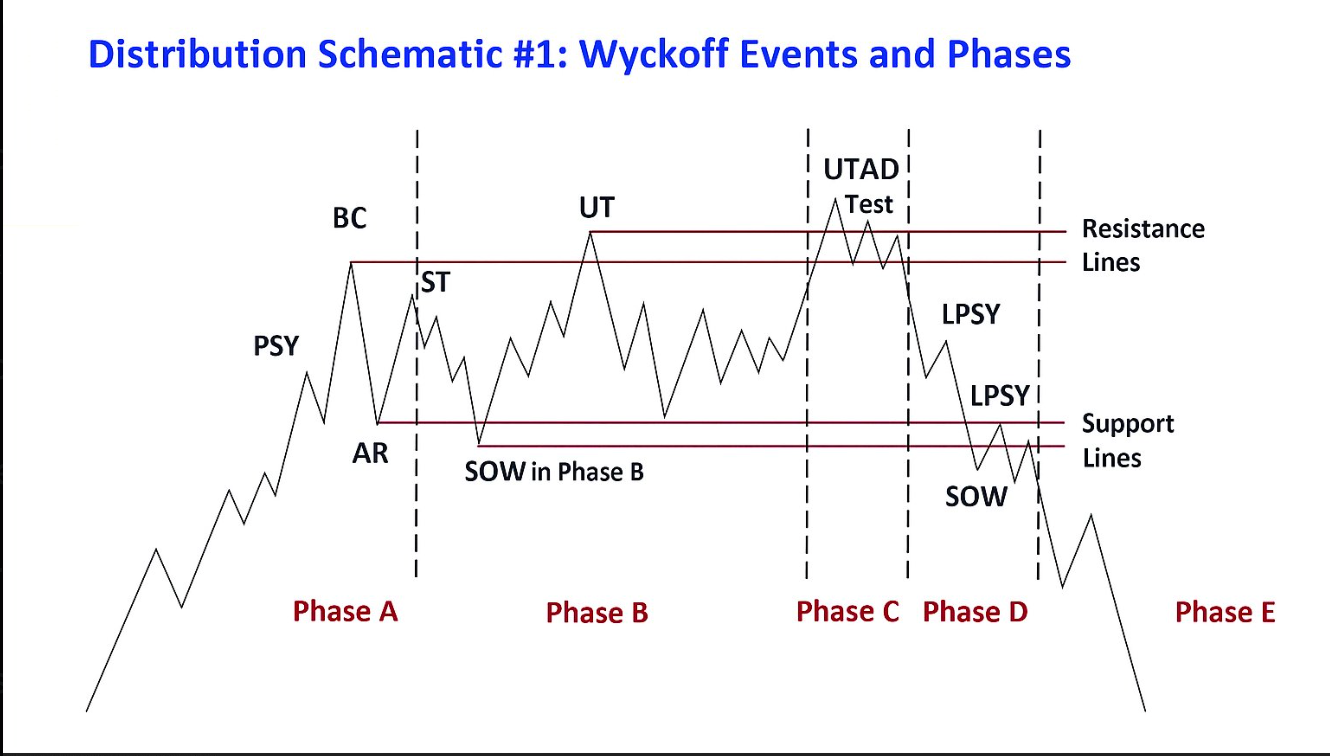

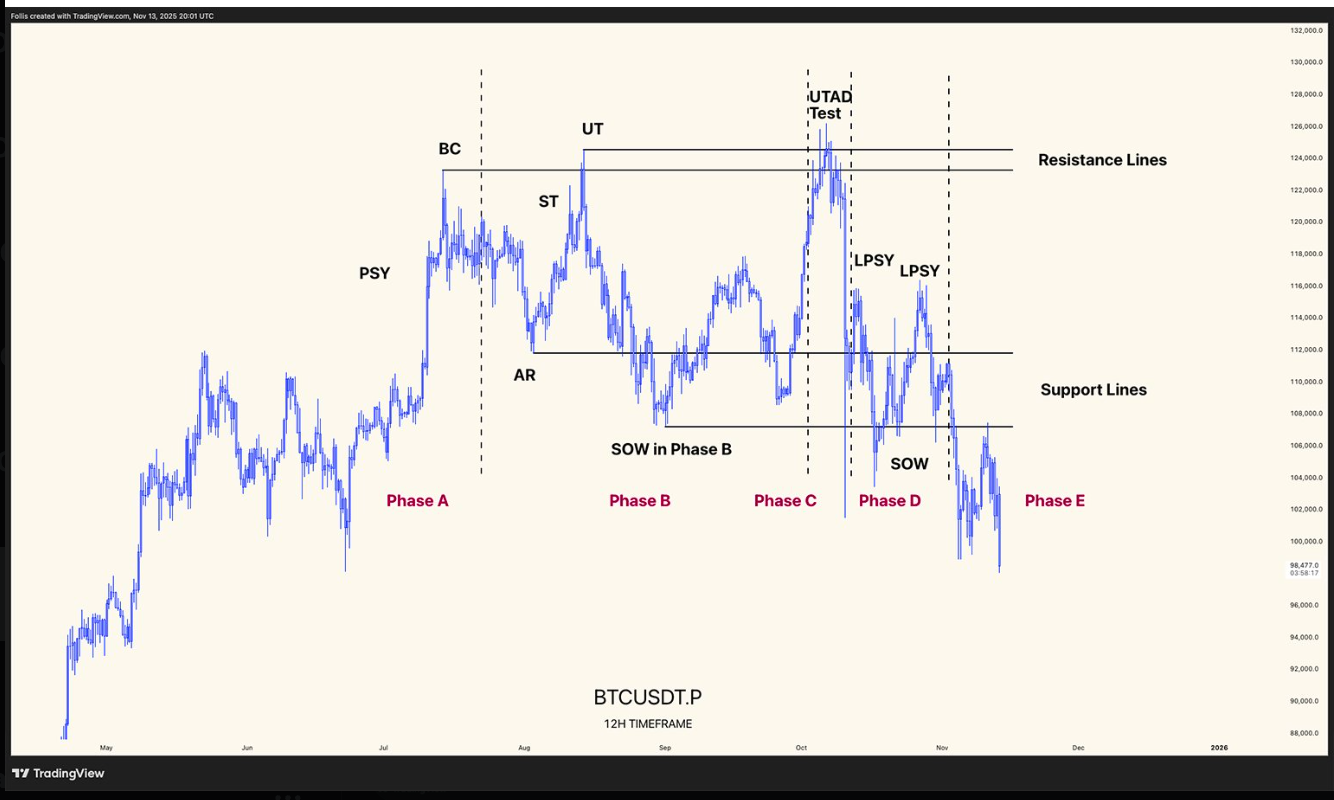

The schematic, highlighted by analyst @follis_ on X, shows Bitcoin’s recent structure tracking the classic five-phase Wyckoff Distribution, a pattern often seen near macro market tops, as shown below.

The alignment is strong enough that the Bitcoin bull market “might actually be over,” @follis_ said.

BTC’s surge above $122,000 marked the Buying Climax (BC), followed by an Automatic Reaction (AR) and Secondary Tests (ST) that failed to create higher highs.

The early-October push toward $126,200 resembled an Upthrust After Distribution (UTAD), a final bullish deviation that signals demand exhaustion.

From there, Bitcoin printed multiple Last Points of Supply (LPSY) and lost mid-range support near $110,000, confirming Phase D.

It dropped below the AR/SOW zone at $102,000–$104,000, then shifted BTC into Phase E, the markdown phase, accelerating the decline. By Friday, BTC had dropped below $95,000 on Binance.

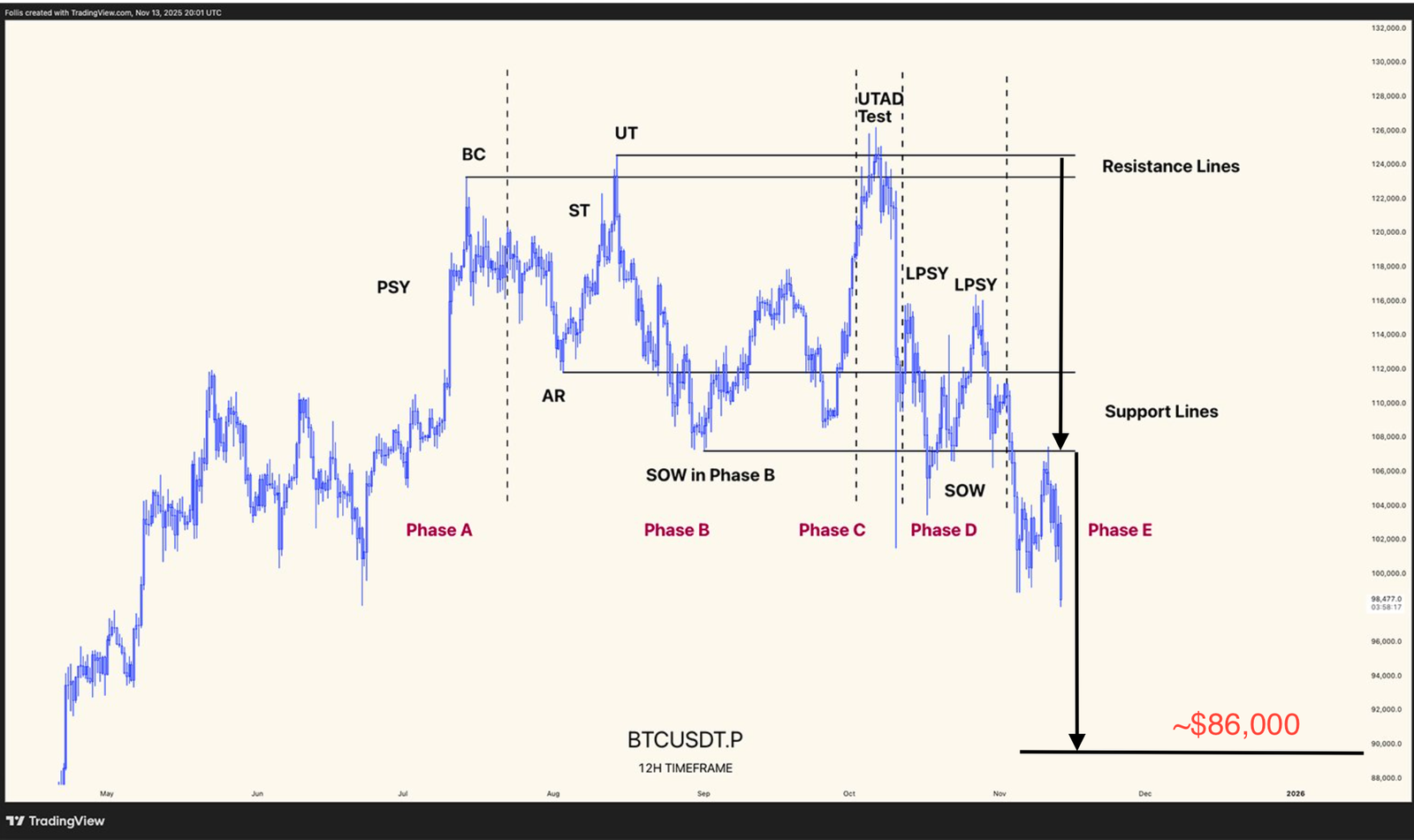

Based on Wyckoff’s measured-move method, the $122,000–$104,000 distribution band implies an $18,000 downside projection, i.e., $86,000 as the primary target.

The bearish shift occurred as global risk appetite deteriorated, driven by fears that the Federal Reserve would not cut interest rates in December.

The US government shutdown, which ended on Thursday, restricted access to key economic data, making policymakers less confident about easing monetary policy. That uncertainty rippled through risk assets, hurting Bitcoin alongside US stocks.

Some Bitcoin analysts are still bullish

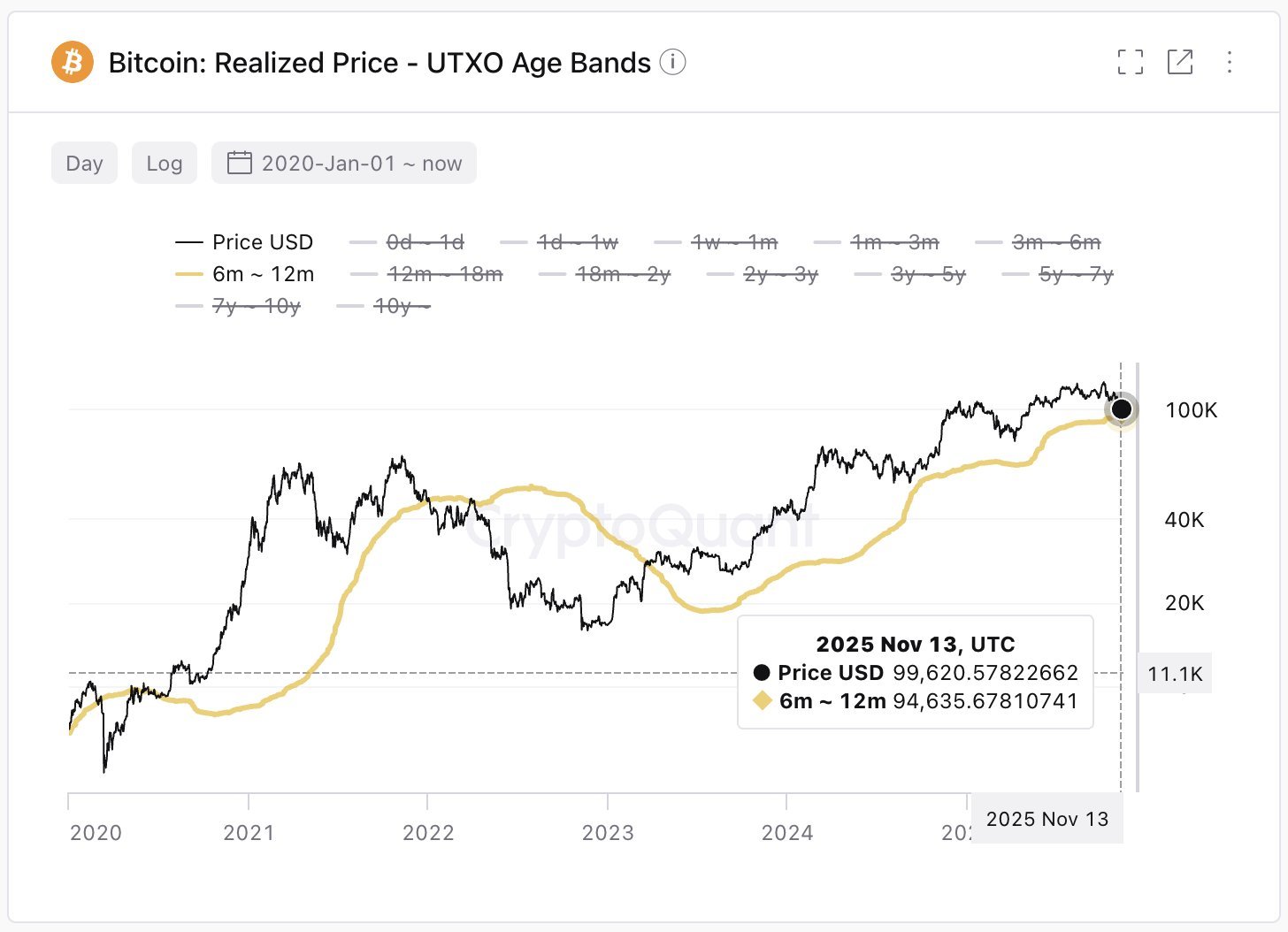

Bitcoin’s broader uptrend remains intact unless the price falls below the key $94,000 level, the average cost basis of six- to 12-month holders, according to CryptoQuant CEO Ki Young Ju.

Related: Bitcoin ETFs bleed $866M in second-worst day on record, but some analysts still bullish

Bitwise CEO Hunter Horsley said Bitcoin “may have been in a bear market for almost six months” and is now nearing the end of it, adding that “the setup for crypto right now has never been stronger.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.