Gold (XAU/USD) struggled to make a decisive move in either direction and spent the week fluctuating within a relatively tight channel at around $4,000. With geopolitics moving to the backseat and the ongoing government shutdown causing postponement of economic data releases in the United States (US), investors will scrutinize comments from Federal Reserve (Fed) policymakers to assess the odds of another interest rate cut in December.

Gold enters a consolidation phase after deep correction

The US Dollar (USD) rally that was fuelled by Fed Chairman Jerome Powell’s cautious remarks on further policy easing in the previous week lost its steam on Monday, allowing XAU/USD to find a foothold. In the second half of the day, the Institute for Supply Management (ISM) reported that the Manufacturing Purchasing Managers’ Index (PMI) declined to 48.7 in October from 49.1 in September. On a positive note, the Employment Index of the survey recovered to 46 from 45.3.

On Tuesday, the USD benefited from the risk-averse market atmosphere as Wall Street’s main indexes suffered large losses after the opening bell. In turn, XAU/USD turned south and lost more than 1.70% on a daily basis. While speaking at the Global Financial Leaders’ Investment Summit in Hong Kong, CEOs of Goldman Sachs and Morgan Stanley warned that there could be a sharp correction of 10%-15% in Equity markets over the next 12-24 months.

Gold managed to stage a rebound on Wednesday as the improving market mood limited the USD’s gains in the second half of the day despite upbeat data. The Automatic Data Processing (ADP) reported that employment in the private sector rose by 42,000 in October, surpassing the market expectation of 25,000, and the ISM announced that the Services PMI edged higher to 52.4, reflecting an ongoing expansion in the service sector’s business activity.

On Thursday, the USD came under heavy bearish pressure and opened the door for an extended recovery in XAU/USD. The monthly report published by Challenger, Gray & Christmas showed that US-based employers cut more than 150,000 jobs in October. This marked the biggest reduction for the month in over two decades. This publication caused investors to refrain from pricing in a Fed policy hold in December and weighed on the USD.

The final data release of the week from the US showed that the University of Michigan’s (UoM) Consumer Sentiment Index declined to 50.3 in November from 53.6 in October. With the USD failing to shake off the bearish pressure heading into the weekend, Gold kept close to the $4,000 region.

Gold investors to assess Fed commentaries

As there are no developments suggesting that the US government shutdown will soon end, it’s safe to assume that upcoming economic data releases, such as the Consumer Price Index (CPI), Retail Sales and Producer Price Index (PPI) for October, will be postponed. Even if the government reopens, it’s unlikely that the data will be published on their originally scheduled dates due to the backlog.

Hence, investors will pay close attention to comments from Fed officials to gauge whether the US central bank is on track to cut the policy rate one more time before the end of the year.

If policymakers voice their concerns over the labor market conditions and adopt an optimistic tone about the inflation outlook, markets could see this as a confirmation of further policy easing. In this scenario, the USD could lose interest and allow XAU/USD to gather bullish momentum.

On the other hand, the USD is likely to hold its ground and make it difficult for XAU/USD to gain traction in case policymakers suggest that they could opt to hold rates steady in December and wait for data to provide a clearer picture of the labor market and inflation dynamics. According to the CME FedWatch Tool, markets are currently pricing in a nearly 65% probability of a 25-basis-points (bps) rate cut in December. This positioning suggests that the USD, and consequently XAU/USD, faces a two-way risk in the short term.

Finally, Gold could remain in a consolidation phase and struggle to find direction if mixed remarks from Fed officials fail to sway market positioning. Chicago Fed President Austan Goolsbee recently said that he would feel uneasy about front-loading rate cuts and added that the threshold for cutting rates at the next meeting is higher than the last two meetings. On a more dovish note, Fed Governor Michael Barr said that the Fed must pay attention to ensuring that the job market remains solid. In the meantime, Cleveland Fed President Beth Hammack adopted a more neutral position, noting that it’s not obvious that the central bank should cut rates again and adding that she is seeing pressure on both sides of the employment and inflation mandates.

Gold technical analysis

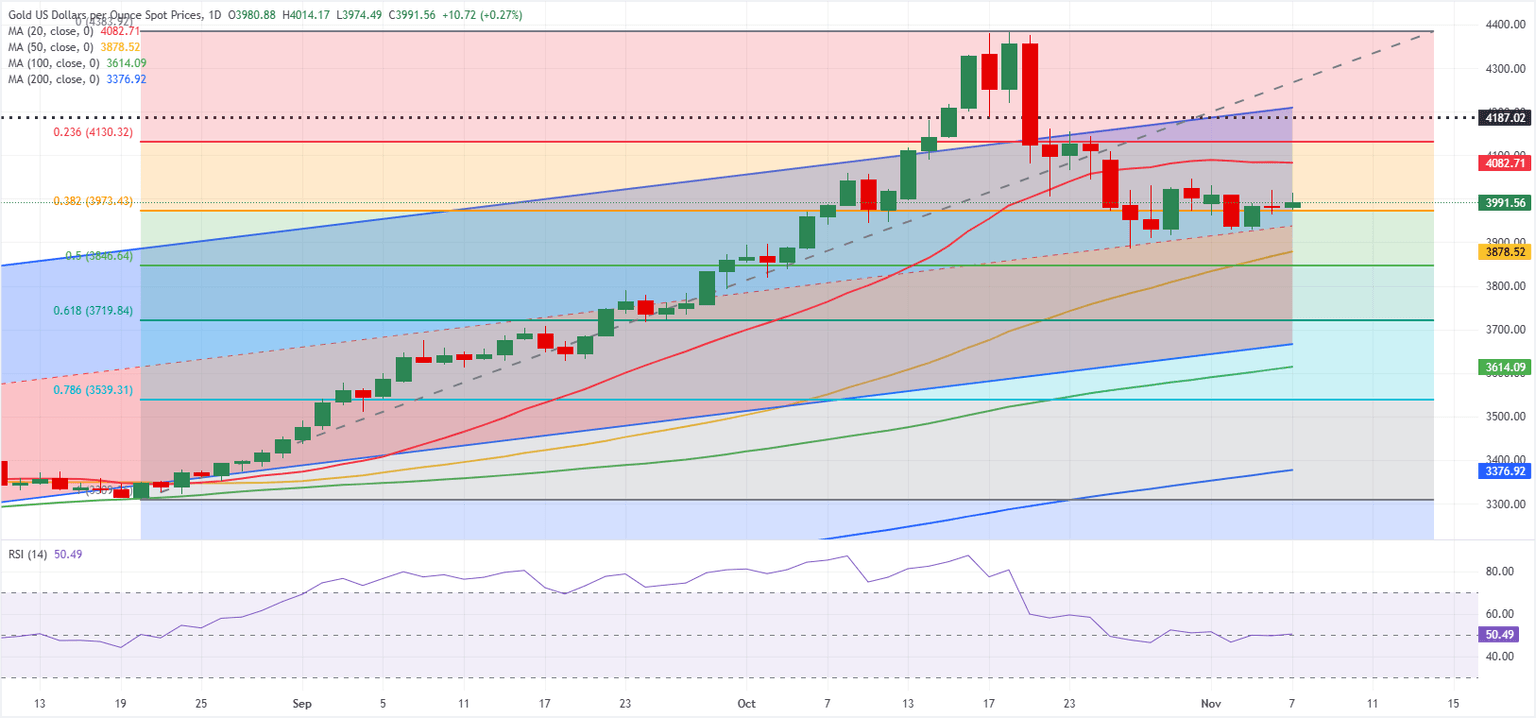

The Relative Strength Index (RSI) momentum indicator on the daily chart moves sideways, slightly above 50, and Gold remains between the 20-day and 50-day Simple Moving Averages (SMA), highlighting a neutral stance in the short term.

On the upside, the 20-day SMA aligns as an interim resistance level near $4,080 ahead of $4,130 (Fibonacci 23.6% retracement of the August-October uptrend) and $4,200-$4,215 (round level, static level, upper limit of the 10-month-old ascending regression channel).

Looking south, support levels could be spotted at $3,940 (mid-point of the ascending channel), $3,880 (50-day SMA) and $3,845 (Fibonacci 50% retracement).

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money.

When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions.

The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.