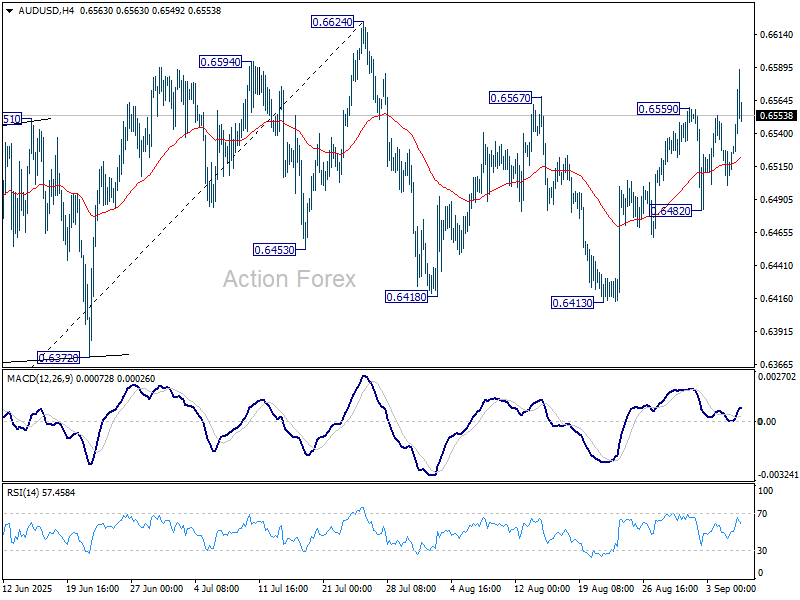

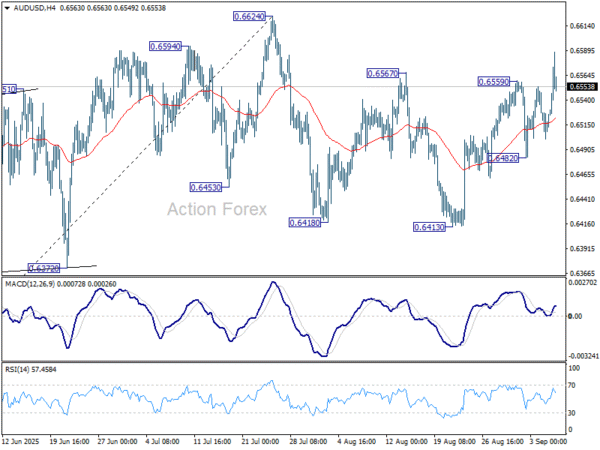

After interim pullback, AUD/USD’s rebound from 0.6413 extended through 0.6567 resistance last week. The development suggests that correction from 0.6624 has already completed. Initial bias is back on the upside for retesting 0.6624 first. Firm break there will resume larger rally from 0.5913 to 0.6713 fibonacci level. For now, risk will stay on the upside as long as 0.6482 support holds, in case of retreat.

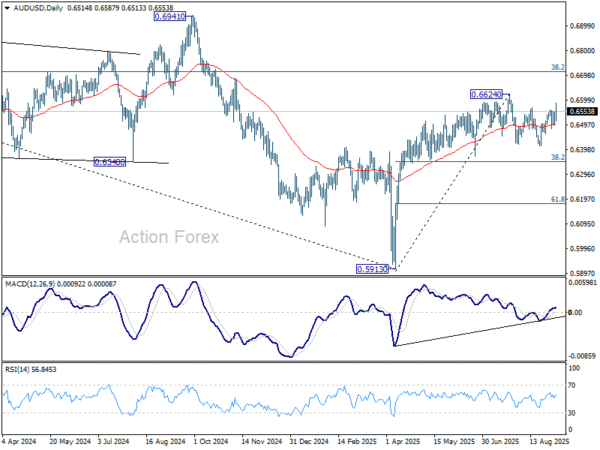

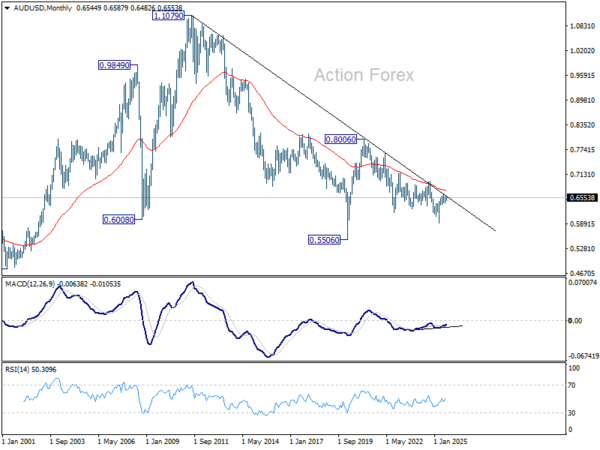

In the bigger picture, there is no clear sign that down trend from 0.8006 (2021 high) has completed. Rebound from 0.5913 is seen as a corrective move. While stronger rally cannot be ruled out, outlook will remain bearish as long as 38.2% retracement of 0.8006 to 0.5913 at 0.6713 holds. Nevertheless, considering bullish convergence condition in W MACD, even in case of another fall through 0.5913, downside should be contained above 0.5506 (2020 low).

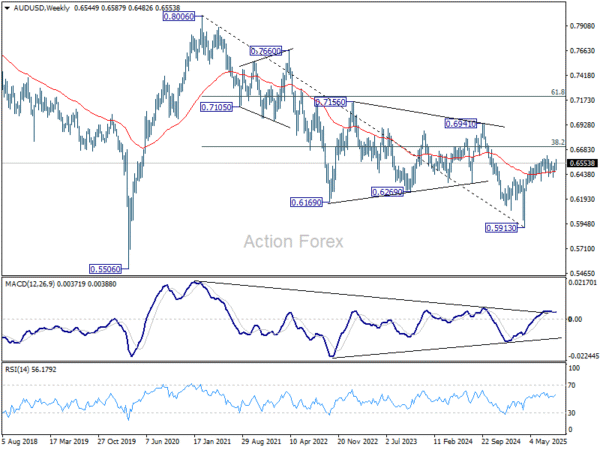

In the long term picture, fall from 0.8006 is seen as the second leg of the corrective pattern from 0.5506 long term bottom (2020 low). Hence, in case of deeper decline, strong support should emerge above 0.5506 to contain downside to bring reversal. On the upside, firm break of 0.6941 will argue that the third leg has already started back to 0.8006.