The Australian economy expanded 0.6% quarter-on-quarter in Q2 2025, surpassing expectations for a 0.5% growth figure and also seeing an upgrade for the earlier period.

On a year-on-year basis, the economy grew 1.8% in the June quarter, marking the fastest pace of growth since September 2023. In addition, the previous GDP figure was revised higher from 0.2% to 0.3% quarterly growth.

Key Takeaways from Australia’s GDP Report

- Growth exceeded expectations: GDP rose 1.8% year-over-year versus 1.6% forecast, with quarterly growth of 0.6% beating the 0.5% estimate

- Domestic demand drove expansion: Household consumption contributed 0.4 percentage points to growth, rising 0.9% as discretionary spending increased 1.4%

- Tourism rebound: Recreation and culture spending surged 2.0%, transport services rose 1.7%, and accommodation services grew 1.9%, partly driven by the Easter and ANZAC day holiday proximity

- Mining sector recovery: Production jumped 2.3% as output rebounded from weather disruptions in the previous quarter, though profits declined due to falling commodity prices

- Investment remained subdued: Total investment fell 0.8%, with public investment declining 3.9% as infrastructure projects near completion

- Household savings compressed: The savings ratio dropped to 4.2% from 5.2% as spending growth outpaced income gains

- Inflation pressures contained: The GDP deflator rose just 0.1%, while the terms of trade fell 1.1% due to weaker commodity prices

Link to Australia’s Gross Domestic Product (Q2 2025)

While headline growth exceeded expectations, underlying fundamentals reveal areas of concern that may influence future RBA policy decisions.

The strength in household consumption, particularly in discretionary categories, suggests consumer confidence may be recovering despite ongoing cost-of-living pressures. However, the decline in the household savings ratio to 4.2% – the lowest level since early 2022 – indicates Australian families are drawing down financial buffers to maintain spending levels.

The mining sector’s production rebound provided a significant boost to quarterly growth, but falling commodity prices continue to pressure profit margins and the terms of trade. Iron ore and coal prices declined due to weakening global demand and oversupply concerns, particularly as China transitions toward renewable energy sources.

Public investment weakness, down 3.9% quarterly, reflects the natural conclusion of major infrastructure projects across multiple jurisdictions. This trend may weigh on future growth unless new capital spending programs are initiated.

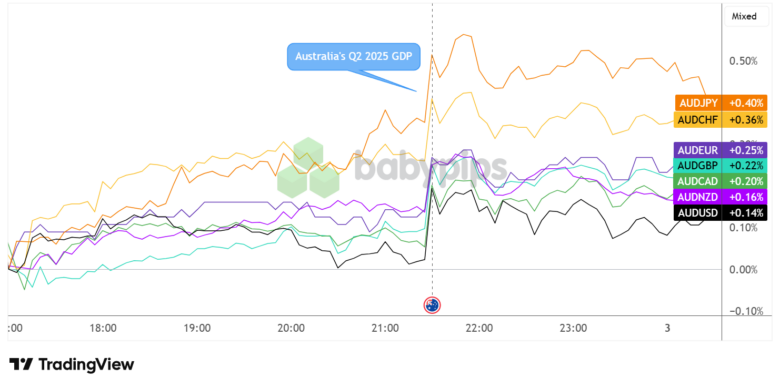

Market Reaction

Australian Dollar vs. Major Currencies: 5-min

Overlay of AUD vs. Major Currencies Chart by TradingView

The Australian dollar, which was already cruising gradually higher leading up to the GDP release, strengthened across the board upon seeing upbeat results.

The currency approximately 0.40% against the Japanese yen and 0.36% against the Swiss franc within hours of the announcement. AUD also advanced 0.25% versus the euro and 0.22% against the British pound, reflecting market confidence in the economic data.