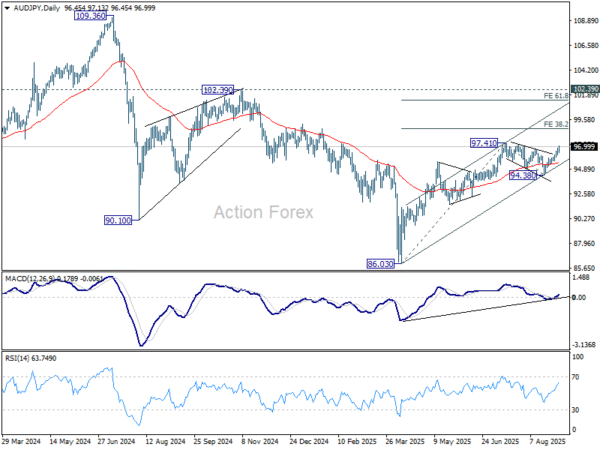

AUD/JPY extended its rally this week, surging toward the 97.41 resistance level and positioning to resume the broader uptrend from the April low of 86.03. The move has been driven by a powerful combination of Australian Dollar strength and Yen weakness, pushing the cross closer to levels not seen since earlier this year.

For Aussie, Q2 GDP surprised to the upside at 1.8% yoy, its strongest expansion since 2023 and above RBA own forecast of 1.6%. Household consumption and government spending were key contributors, while net trade added to growth thanks to stronger iron ore and LNG exports. The data reinforced a picture of an economy proving more resilient than feared. Meanwhile, inflationary pressures remain sticky. Released last week, July CPI accelerated to 2.8% year-on-year, a reminder that consumer demand is still strong and disinflation is not guaranteed.

Recent data reinforces that the RBA is firmly on hold this month, with November shaping up as the earliest window for another rate cut. Even then, any rate cuts are likely to remain gradual given the still-firm growth and inflation backdrop.

On the Yen side, stalled trade negotiation process is adding strain. Hopes for a U.S. executive order to reduce auto tariffs remain unfulfilled, and Deputy Governor Ryozo Himino’s warning about downside risks to growth underscores the BoJ’s reluctance to tighten further in the near term. Yen’s position has also been eroded by this week’s surge in global bond yields, led by gilts.

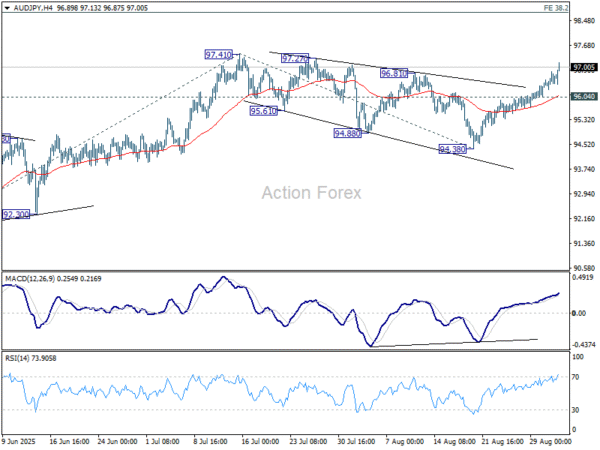

Technically, today’s break above 96.81 resistance suggests that AUD/JPY’s correction from 97.41 completed as a five-wave triangle at 94.38. As long as 96.04 minor support holds, the bias remains firmly upward. Decisive break of 97.41 would resume the rise from 86.03, targeting the 38.2% projection of 86.03 to 97.41 from 94.38 at 98.72. Further break there break there could prompt upside acceleration to 61.8% projection at 101.41.

Looking medium term, the broader corrective downtrend from 2024 high at 109.36 should have completed with three waves down to 86.03. If that scenario holds, clearing structural resistance at 102.39 could open the way for a full retest of 109.36.