Dutch cryptocurrency service provider Amdax raised 20 million euros ($23.3 million) to launch a Bitcoin treasury company on Amsterdam’s Euronext stock exchange.

According to a Friday announcement, multiple investors have committed about $23.3 million in an initial financing round for Amdax’s Bitcoin (BTC) treasury. This follows an announcement earlier this month that it would launch the treasury as an independent, privately held company with its own governance, AMBTS.

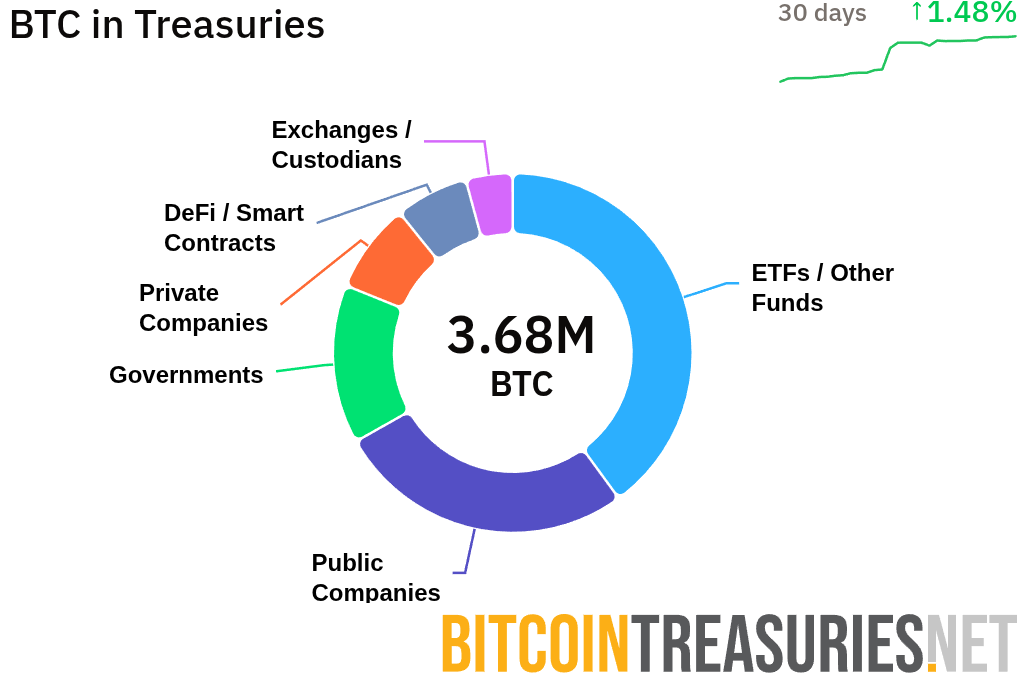

AMBTS is being created to eventually accumulate at least 1% of all Bitcoin that will ever be created, or about 210,000 BTC. Such an amount of Bitcoin is currently worth over $23 billion.

“AMBTS intends to leverage the capital markets to increase its Bitcoin holdings and sequentially generate equity appreciation and grow Bitcoin per share for its shareholders, subject to market and other conditions,” the announcement said.

Related: The Bitcoin treasury model is breaking, but Strategy’s isn’t. Here’s why

The rise of corporate Bitcoin treasuries

Ever since Strategy — then still MicroStrategy — demonstrated the viability of this approach, the Bitcoin treasury tactic has been gaining momentum among publicly traded companies.

This trend has also led to multiple companies not focused solely on Bitcoin accumulation starting to acquire it. Such firms include US electric vehicle manufacturer Tesla, US thermal and battery safety firm KULR Technology, Norwegian industrial investment firm Aker, Brazilian fintech Méliuz, Latin America’s leading e-commerce MercadoLibre, Malta-based investment manager Samara, Thai telecom Jasmine, US coal producer Alliance and Canadian video-sharing platform Rumble.

Companies focused on acquiring Bitcoin, meanwhile, have continued to accumulate more. This also decreases the amount of Bitcoin in circulation.

Related: Satsuma secures $218M, including $125M in BTC, to advance Bitcoin strategy

Bitcoin’s accumulation continues

Earlier this week, Japanese Bitcoin treasury Metaplanet approved a plan to raise about $880 million through an overseas share issuance, with nearly $835 million allocated for Bitcoin purchases. Also this week, French semiconductor company Sequans Communications filed for a $200 million at-the-market equity offering on Monday to fuel its Bitcoin treasury strategy.

Earlier this month, Michael Saylor, the co-founder of the world’s first Bitcoin treasury company Strategy, signaled an impending Bitcoin acquisition that would constitute the company’s third one in August. Strategy is currently the world’s largest Bitcoin treasury, holding 632,457 BTC worth over $69.5 billion at the time of writing, equivalent to over 3% of all Bitcoin that will ever be mined.

Magazine: Bitcoin is ‘funny internet money’ during a crisis: Tezos co-founder